The once-fragmented and cumbersome process of verifying one’s identity for significant life events has undergone a fundamental and irreversible shift, driven by a confluence of powerful consumer demand and rapid technological innovation. The foundation for this new era was firmly established by 2025, as industries from finance to real estate moved decisively away from manual, in-person checks and repetitive form-filling. Consumers now expect verification to be a seamless, mobile-first, and nearly instantaneous experience, mirroring the user-friendliness of other digital services. In response, sectors like property transactions accelerated their adoption of advanced digital identity verification (IDV). This was not merely a compliance exercise but a strategic imperative to collapse transaction timelines, elevate the customer journey, and erect more formidable defenses against fraud. Sophisticated solutions incorporating real-time liveness checks to thwart spoofing attempts, Near Field Communication (NFC) chip reading for high-assurance document validation, and automated anti-money laundering (AML) screening have become the new standard, integrated directly into core business systems.

The Dawn of Reusable Compliance

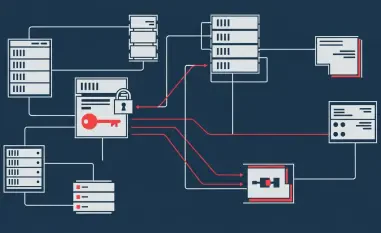

At the heart of this transformation is the concept of “reusable compliance,” a model that has become a reality through the widespread adoption of digital wallets. These secure mobile applications empower individuals to store their verified identity credentials following a single, thorough, and high-integrity verification event. This approach directly addresses the profound inefficiencies that plagued legacy systems, most notably illustrated by the typical home-buying journey, where a consumer was often required to undergo the same identity verification an average of 5.4 separate times. By championing a “verify once, share many times” philosophy, these wallets are fundamentally altering the velocity of complex transactions. They effectively eliminate vast swathes of redundant administrative labor across the property ecosystem and provide a more cohesive and robust defense against the ever-present and growing risk of sophisticated identity fraud, creating a more streamlined and secure environment for all participants.

This wallet-based model has effectively made identity verification a portable, user-centric asset, allowing individuals to carry their verified credentials with them on their personal devices. A pivotal feature of this new paradigm is the principle of selective disclosure, which grants users the ability to share only the specific attributes necessary for a given interaction—such as proof of age, address confirmation, or validation of funds—without exposing their entire identity profile or needing to endure a full re-verification process. This “compliance on the move” framework offers substantial, tangible benefits for professionals such as estate agents and property lawyers. It translates into dramatically faster client onboarding, a significantly lower risk of identity fraud due to the high-assurance nature of the initial verification, and greater confidence in the authenticity and origin of the credentials presented. Furthermore, it establishes more consistent and standardized compliance practices across the industry, enhanced by the ability to run instant, real-time checks against Politically Exposed Persons (PEP) and international sanctions lists.

Navigating a Complex and Evolving Landscape

While the benefits are clear, this transition has not been without significant challenges, forcing businesses to navigate an environment of increasing regulatory complexity and unprecedented fraud sophistication. Governmental bodies and industry regulators are pushing for higher-integrity identity checks, complete and immutable auditability of all verification processes, and demonstrably effective AML controls to combat financial crime. Concurrently, the threat landscape has become markedly more dangerous. The proliferation of artificial intelligence has fueled a new generation of highly sophisticated identity attacks, including deepfake-enabled impersonation attempts capable of deceiving all but the most advanced security systems. Public concern has risen in tandem, with studies indicating that a majority of homeowners are worried about the potential for AI-driven identity theft. To counteract these evolving threats, firms have had to adopt and continuously update robust liveness detection and document integrity technologies that evolve as rapidly as the fraudulent methods they are designed to combat.

This profound shift toward reusable digital wallets has not occurred in a vacuum; it aligns perfectly with a broader, deliberate government strategy. Regulatory bodies, including the UK’s Department for Science, Innovation and Technology (DSIT) and HM Treasury, have provided clearer guidance supporting the adoption of interoperable, portable digital identities, harmonizing with established frameworks such as the UK’s Digital Identity and Attributes Trust Framework and parallel EU legislation. A pivotal regulatory development was the Financial Conduct Authority (FCA) assuming AML supervision for the legal sector. This move triggered a decisive migration away from traditional, manual file reviews toward a more data-led, technology-driven supervisory model. This placed a significant premium on verification systems that are not only secure and efficient but also easily auditable and constructed upon recognized, government-endorsed standards, cementing the role of digital wallets as an essential component of modern compliance infrastructure rather than a mere technological novelty.

A New Paradigm for Digital Trust

By the close of 2026, the reusable digital identity had firmly established itself as the default expectation for property transactions and other high-value interactions. This monumental change was not driven by a top-down government mandate but by an organic, market-wide recognition of the superior efficiency, enhanced security, and improved user experience the model offered. Consumers, agents, lenders, and conveyancers all embraced the new standard, drawn by its promise of a frictionless journey. The user experience was transformed into something akin to a “digital passport for homebuyers,” which allowed individuals to move seamlessly through the various stages of a complex transaction with a single, trusted, and portable identity. The organizations that had acted as early adopters of this wallet-based ecosystem gained a significant and durable competitive advantage. They realized tangible benefits in the form of faster completion times, substantially lower exposure to fraud, and a dramatic reduction in their administrative and compliance overhead, marking this year as the dawn of a new era in digital identity.