As decentralized networks grapple with the monumental challenge of securely onboarding millions of users, the bottleneck of identity verification has become a primary obstacle to growth and mainstream adoption. Addressing this critical juncture, the Pi Network has initiated a significant strategic overhaul centered on integrating artificial intelligence into its Know Your Customer (KYC) protocols. This technological pivot is not merely an incremental upgrade but a foundational shift designed to resolve long-standing verification delays and prepare the ecosystem for a major token unlock. The move aims to streamline the path to Mainnet for a massive user base, transforming a complex and often slow process into a more efficient and scalable system ahead of a crucial liquidity event.

A Strategic Overhaul of Identity Verification

The Mechanics of AI Driven KYC Integration

The core of this strategic initiative involves the large-scale deployment of AI automation across the network’s standard KYC workflows, a development that effectively absorbs the previously distinct “Fast Track” system into the default verification process for all users. This integration is engineered to extend the benefits of accelerated processing to the entire user base, rather than a select few. The core team projects that this enhancement will reduce the number of verification cases requiring manual intervention by a human validator by as much as fifty percent. Such a dramatic reduction in manual reviews is poised to significantly shorten the waiting period for both new Pioneers joining the network and dormant users who were previously stalled in the verification pipeline. By automating the most repetitive and data-intensive aspects of identity confirmation, the network can reallocate its human resources to focus on more complex edge cases, thereby improving both the speed and the overall integrity of the system. This is a calculated move to unblock a critical chokepoint in user migration before the network experiences a significant increase in transactional activity.

This technological push is inextricably linked to the network’s preparation for a substantial token unlock scheduled for this December, which will release over 190 million Pi tokens into the ecosystem, carrying an approximate market value of $43 million. The impending influx of liquidity places immense pressure on the network to ensure a larger and more robust cohort of its user base is fully migrated to the Mainnet. A successful unlock event hinges on having a critical mass of verified users who can participate in the ecosystem, transact, and utilize applications, thereby absorbing the new supply and fostering a stable market environment. The AI-driven KYC acceleration is therefore not just a user-experience improvement but a crucial risk mitigation strategy. By expediting the migration of millions of users, the network aims to fortify its on-chain economy, ensuring that the infrastructure is ready to support the increased activity and value that the token unlock is expected to generate, preventing potential instability.

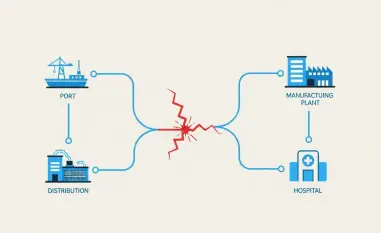

Addressing the User Verification Backlog

According to recent project reports, the network has achieved a significant milestone, with 17.5 million users having successfully completed their KYC checks. Of this group, an impressive 15.7 million have already finalized their migration to the Mainnet, representing a substantial foundation for the ecosystem. However, a persistent challenge remains in the form of approximately 3 million users who are currently stuck in various states of partial or incomplete verification. This segment of the user base represents a significant untapped potential for network growth and decentralization. The newly implemented AI-driven system is specifically engineered to address this backlog by intelligently processing incomplete applications, flagging specific issues for user correction, and automating the re-evaluation process. The goal is to efficiently guide these stalled users through the final steps of verification, effectively clearing the pipeline and converting them into active Mainnet participants. This targeted approach is vital for unlocking the full potential of the network’s massive social graph.

In a related operational update that underscores the project’s focus on long-term stability, the distribution of rewards for network validators has been officially postponed to the latter part of the first quarter of 2026. This decision was attributed to the immense and complex volume of validation data that has been accumulated since the system’s early phases began in 2021. The core team explained that a thorough and meticulous analysis of this extensive dataset is required to calculate accurate and fair reward payouts. Rushing the process could lead to errors and inequities, undermining the trust of the very community members who help secure the network. This delay, while potentially disappointing for validators in the short term, signals a mature approach to network management. It reflects a prioritization of data integrity and system correctness over expediency, ensuring that the foundational economic incentives of the network are sound before scaling them further. This careful handling of historical data aligns with the broader theme of building a robust and sustainable infrastructure.

Expanding the Ecosystem and Market Position

Regulatory Compliance and New Utility Horizons

Beyond its internal technical upgrades, Pi Network is actively working to solidify its position within the broader global regulatory landscape. A crucial advancement in this domain is the project’s successful listing within the European Union’s Markets in Crypto-Assets (MiCA) regulatory framework. This is a pivotal step that provides a clear path for the network to operate within regulated European markets, enhancing its legitimacy and appeal to a more mainstream audience. Compliance with MiCA signifies a commitment to consumer protection, market integrity, and financial stability, differentiating Pi from many other projects operating in a legal gray area. By proactively engaging with established regulatory structures, the network is not only mitigating future legal risks but also positioning its proprietary identity validation infrastructure as a potential service for other enterprises that require a compliant, human-verified user base, opening up new avenues for ecosystem growth and revenue.

Simultaneously, the project is making a concerted effort to foster tangible utility for its token and platform through strategic partnerships. A notable example of this strategy is a recent collaboration with CiDi Games, which will see the integration of Pi-based functionalities into the realm of Web3 entertainment. This partnership moves the Pi token beyond a purely speculative asset, embedding it within an interactive ecosystem where it can be earned, spent, and utilized in a gaming environment. By creating such practical use cases, the network encourages active participation and drives organic demand for its currency. This approach is part of a broader ambition to build a vibrant and multifaceted ecosystem where Pi serves as the transactional backbone for a wide array of decentralized applications, from social media to finance and entertainment. These initiatives are essential for building long-term value and demonstrating the real-world applicability of the network’s technology.

Market Reaction and Future Outlook

Despite the significant fundamental developments occurring within the ecosystem, the market performance of the PI token has remained relatively subdued. At the time of the latest reports, the token was trading near the $0.2265 mark, reflecting only a modest gain on the daily charts. An analysis of key technical indicators offers further insight into the prevailing market sentiment. The Relative Strength Index (RSI), a popular momentum oscillator, is hovering near the 45 level, a neutral position that suggests neither strong buying nor selling pressure is currently dominating the market. Furthermore, the Moving Average Convergence Divergence (MACD) indicator remains flat, reinforcing the notion of a market in equilibrium or consolidation. This lack of strong directional momentum indicates that traders and investors are largely adopting a cautious, “wait-and-see” approach, holding back on making significant moves until a clearer trend emerges. The price action suggests that the market has not yet fully priced in the potential long-term benefits of the AI-driven KYC and ecosystem expansions.

The prevailing consensus among market observers is that the current sideways trading reflects a period of anticipation, with the market awaiting tangible evidence that the network’s strategic initiatives can translate into renewed token demand and on-chain activity. Investors are closely watching to see if the accelerated migration of millions of users to the Mainnet will lead to a measurable increase in transactions, application usage, and overall network value. The creation of new utility through partnerships like the one with CiDi Games is seen as a positive step, but its ultimate impact on token velocity and demand remains to be proven. The influential December unlock event looms large as the next major catalyst. How the market absorbs the new supply of over 190 million tokens will serve as a critical test for the ecosystem’s maturity and could be the decisive factor that either validates the network’s recent upgrades or signals further consolidation. The outcome of this event is widely expected to set the tone for the token’s trajectory in the coming months.

A Calculated Push Toward Maturity

The convergence of AI-driven infrastructure upgrades, proactive regulatory engagement, and a focused push for real-world utility marked a definitive turning point for the Pi Network. These actions collectively signaled a transition from a project in a prolonged development phase to a functional ecosystem preparing for mainstream operation. The successful resolution of the long-standing KYC bottleneck was not merely a technical fix; it was a foundational step that unlocked the potential of millions of users. By concurrently establishing a foothold in compliant markets and building out tangible use cases, the network laid the groundwork for sustainable growth. These strategic moves addressed critical operational challenges and ultimately positioned the platform to better manage the complexities and responsibilities that came with a larger, fully-migrated user base on its Mainnet.