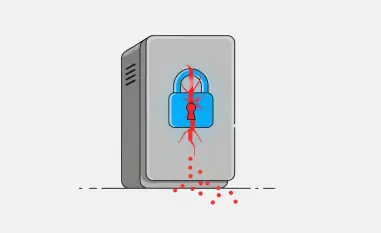

In an era where digital transformation accelerates at an unprecedented pace, the cybersecurity industry stands as the frontline defense against an alarming statistic: global cybercrime costs are projected to reach $10.5 trillion annually by 2025, highlighting the critical need for robust security solutions. This staggering figure underscores the urgency for businesses to navigate an increasingly complex threat landscape, where data breaches, ransomware, and AI-driven attacks grow more sophisticated, putting immense pressure on companies to safeguard their digital assets. This report delves into how Palo Alto Networks (PANW), a titan in the cybersecurity realm, is spearheading innovation through its platform strategy, setting a benchmark for the industry amidst evolving challenges.

The Evolving Landscape of Cybersecurity

The cybersecurity sector has emerged as a cornerstone of the digital age, protecting enterprises from an ever-growing array of threats that exploit vulnerabilities in interconnected systems. As organizations adopt cloud technologies and remote work models, the attack surface has expanded, making security not just a technical necessity but a business imperative. This dynamic environment sees annual global spending on cybersecurity surpassing $150 billion, driven by the urgent need to counter risks that can cripple operations and erode customer trust.

Key segments such as network security, cloud security, and identity management define the industry, with major players like PANW, Cisco, and Fortinet vying for dominance. Technological advancements, particularly artificial intelligence (AI) and cloud migration, are reshaping how threats are detected and mitigated, enabling real-time responses to sophisticated attacks. These innovations are critical as cybercriminals leverage similar technologies to orchestrate breaches, pushing companies to stay ahead of the curve.

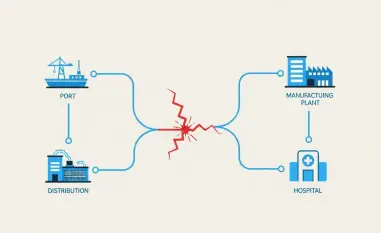

Digital transformation, while fueling growth, also amplifies the complexity of cyber threats, with trends like the Internet of Things (IoT) and hybrid work environments introducing new vulnerabilities. The shift toward integrated solutions over point products reflects a broader industry realization: fragmented defenses are no longer sufficient. This convergence of technology and threat evolution sets the stage for comprehensive platforms that can address multifaceted risks holistically.

Palo Alto Networks’ Platformization Approach

Redefining Security with an Integrated Ecosystem

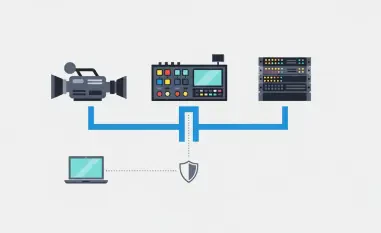

Palo Alto Networks has strategically pivoted from offering standalone security products to building a unified, cloud-native platform that seamlessly integrates network, cloud, and identity security. This shift addresses a critical pain point for enterprises—managing disparate tools that often fail to communicate effectively, leaving gaps for attackers to exploit. By consolidating these functions, PANW enables businesses to streamline operations and fortify their defenses with a cohesive approach.

The platform strategy not only simplifies security management but also enhances threat detection through advanced analytics and automation. This interoperability creates a competitive advantage, as customers benefit from a synchronized ecosystem that reduces response times to incidents. Furthermore, the high switching costs associated with such integrated systems foster customer loyalty, positioning PANW as a preferred partner in a crowded market.

This move toward platformization reflects a broader industry trend where comprehensive solutions are favored over siloed products. By embedding scalability and adaptability into its offerings, PANW ensures that enterprises can future-proof their security posture against emerging threats. This approach has redefined expectations, compelling competitors to rethink their strategies in order to keep pace.

Financial Success and Market Performance

Financially, PANW demonstrates the efficacy of its platform focus with impressive metrics that highlight sustained growth. In the second quarter of the current year, the company reported a 37% year-over-year increase in Next-Generation Security Annual Recurring Revenue (NGS ARR), reaching $4.8 billion, while Remaining Performance Obligation (RPO) grew to $13.0 billion, signaling strong future revenue streams. These figures underscore the market’s confidence in PANW’s offerings.

Looking ahead, projections for the full year anticipate NGS ARR to range between $5.52 billion and $5.57 billion, reflecting consistent momentum. Operational efficiency shines through with a robust 38% free cash flow margin, providing ample resources for reinvestment in innovation and shareholder value. Such financial health positions PANW to capitalize on expansion opportunities while maintaining a strong balance sheet.

These metrics offer a forward-looking perspective, suggesting that PANW is well-equipped to navigate market fluctuations and invest in cutting-edge technologies. The combination of recurring revenue growth and operational discipline paints a picture of a company not just surviving but thriving in a competitive landscape, setting a high bar for industry peers.

Challenges in the Cybersecurity Arena

The cybersecurity industry, including PANW, grapples with formidable challenges as threats evolve with alarming sophistication, often powered by AI to bypass traditional defenses. These advanced attacks, such as deepfake-driven social engineering, demand constant vigilance and innovation, testing the limits of even the most robust systems. Staying ahead requires not just reactive measures but proactive anticipation of attack vectors.

Competitive pressures add another layer of complexity, as numerous vendors vie for market share, potentially leading to saturation in recurring revenue models. This environment necessitates continuous differentiation through unique value propositions, a challenge PANW meets head-on by enhancing its platform’s capabilities. However, the risk of complacency looms large if innovation slows, allowing nimbler rivals to close the gap.

To counter these obstacles, PANW employs strategic acquisitions and expands its ecosystem through partnerships, ensuring agility in addressing new threats. By integrating complementary technologies and fostering a network of over 3,000 global channel partners, the company mitigates risks and maintains its edge. This adaptability is crucial in an arena where stagnation can quickly erode market leadership.

Navigating the Regulatory and Compliance Environment

The regulatory landscape profoundly impacts cybersecurity, with stringent data protection laws like GDPR and CCPA imposing rigorous standards on how data is handled and secured. These regulations, coupled with increasing scrutiny over acquisitions, create a complex environment where compliance is non-negotiable. For PANW, aligning with these mandates is not just a legal obligation but a market differentiator.

Compliance in areas like identity and access management remains paramount, as breaches often stem from compromised credentials. PANW’s platform is designed to meet global security standards, incorporating features that support adherence to evolving requirements. This focus builds trust with clients who prioritize vendors capable of navigating the intricate web of regulatory demands.

Partnerships and integrations play a vital role in bolstering PANW’s compliance capabilities, enabling seamless alignment with regional and sector-specific rules. By collaborating with industry stakeholders, the company ensures its solutions remain relevant amidst shifting policies. This proactive stance enhances customer confidence, reinforcing PANW’s reputation as a reliable steward of sensitive data.

Future Horizons for PANW and Cybersecurity

Looking to the horizon, the cybersecurity industry is poised for transformation, driven by emerging technologies like AI-powered security and enterprise browser solutions. These innovations promise to redefine how threats are managed, with AI enabling predictive defenses that preempt attacks before they materialize. PANW’s early investments in such areas position it to lead this technological wave.

Strategic alignment with trends such as cloud adoption and market consolidation further strengthens PANW’s outlook, with ambitious targets like achieving $15 billion in NGS ARR by 2030. This goal reflects confidence in sustained demand for integrated platforms as enterprises seek fewer, more capable vendors. However, potential disruptors, including economic downturns, could temper growth if budgets tighten.

Customer preferences for holistic solutions over fragmented tools will likely shape market dynamics, benefiting leaders like PANW who prioritize integration. Global economic conditions may influence adoption rates, yet the undeniable necessity of cybersecurity ensures resilience. Monitoring these factors will be essential to understanding how PANW and the industry adapt to an unpredictable future.

Conclusion

Reflecting on the insights gathered, it becomes evident that Palo Alto Networks has carved a formidable path in cybersecurity through its innovative platform strategy, adeptly addressing the multifaceted threats of the digital age. The company’s financial robustness and strategic foresight stand out as pillars of its success during this analysis. Moving forward, stakeholders should prioritize tracking regulatory developments to mitigate risks while investing in partnerships that amplify technological advancements. Embracing AI-driven solutions and expanding identity security offerings emerge as critical steps to maintain momentum. As the industry consolidates, PANW’s ability to anticipate customer needs and adapt to global shifts promises to sustain its leadership, offering a blueprint for navigating the complex cybersecurity terrain ahead.