Palo Alto Networks (PANW) has carved out a prominent position in the dynamic and rapidly evolving cybersecurity industry. The company’s robust financial performance, strategic initiatives, and focus on innovation provide solid foundations for future growth. This article delves into the various facets that make Palo Alto Networks not just a current leader but also a company well-positioned for future expansion.

Financial Performance and Key Metrics

Palo Alto Networks has demonstrated impressive financial results, particularly in the fourth quarter of fiscal year 2024. The company reported a year-over-year revenue increase of 12.1%, bringing in $2.19 billion. Several key factors drive this growth, highlighting the company’s agility and market adaptability.

A notable contributor to PANW’s revenue is its Subscription and Support segment, which experienced an 18.2% increase compared to the previous year. Additionally, the Next-Generation Security (NGS) Annual Recurring Revenue (ARR) showcased a remarkable 42.8% year-over-year increase, reaching an impressive $4.22 billion. This financial robustness underscores the increasing demand for Palo Alto Networks’ cybersecurity solutions and the company’s ability to capture market share.

Moreover, billings grew by 10.8% to .5 billion, surpassing market expectations. The company’s Remaining Performance Obligations (RPO) also grew by 19.8% to .7 billion, indicating a strong future revenue pipeline. These metrics reflect not just current success but also a healthy trajectory for future growth, making PANW an appealing choice for investors.

Strategic Initiatives and Product Performance

The company’s strategic focus on platformization—integrating various security solutions into a comprehensive platform—has proven fruitful. By the end of FY24, over 1,000 platformization deals were recorded, illustrating significant traction. This strategic direction simplifies security management for clients and creates cross-selling opportunities, enhancing customer retention and revenue per customer.

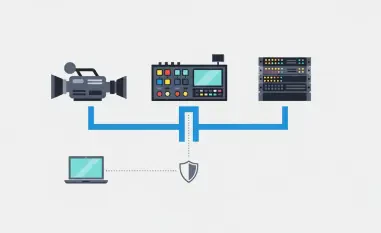

Part of PANW’s success comes from its cloud security business, CloudSec, which surpassed $700 million in Annual Recurring Revenue (ARR). Such growth indicates the company’s strong foothold in the cloud security market, responding well to the increasing shift towards cloud operations among enterprises.

Additionally, Palo Alto Networks’ Cortex product line, driven by its Extended Security Intelligence and Automation Management (XSIAM) product, achieved notable milestones. Cortex crossed $900 million in ARR, with bookings exceeding $500 million and a quadrupling of its customer base in FY24. The Secure Access Service Edge (SASE) offering also gained momentum, welcoming approximately 300 new customers. This continued expansion showcases PANW’s ability to meet the growing demand for cloud-delivered security services and reinforces the effectiveness of its strategic initiatives.

Industry Trends and Competitive Landscape

The cybersecurity industry is transforming rapidly, driven by the increasing complexity of cyber threats and ongoing digital transformation across various sectors. Palo Alto Networks’ focus on AI-driven solutions and cloud security positions it favorably to capitalize on these industry trends.

However, the competitive landscape remains intense. Established players and innovative startups continuously vie for market share, requiring PANW to sustain a high level of innovation. This need for constant evolution presents both a challenge and an opportunity, as the company must balance maintaining its competitive edge with adapting to new market dynamics.

Despite the competition, PANW’s comprehensive product portfolio and strategic focus provide a solid foundation. The company’s ability to leverage emerging technologies, such as AI and machine learning, to develop innovative solutions will be crucial in maintaining its leadership position. These industry trends and competitive challenges underscore the importance of ongoing strategic adaptation and innovation for Palo Alto Networks.

Future Outlook and Guidance

For FY25, Palo Alto Networks has offered a positive outlook, exceeding analyst expectations. The company projects a revenue growth rate of 13-14% for the fiscal year, driven primarily by its Next-Generation Security Annual Recurring Revenue (NGS ARR), which is expected to grow by approximately 29%.

Moreover, PANW anticipates its Free Cash Flow (FCF) Margin to be between 37-38%, reflecting financial health and operational efficiency. These projections underscore the company’s confidence in its strategic direction and its ability to navigate market complexities.

The emphasis on platformization and cloud security is expected to continue driving growth. PANW’s strategic initiatives are designed to tap into the expanding demand for cybersecurity solutions, driven by digital transformation and increasing cyber threats. This optimistic outlook positions Palo Alto Networks well for sustained growth and market leadership.

Shift from Billings to RPO Guidance

An important aspect of Palo Alto Networks’ future strategy involves transitioning from billings guidance to RPO guidance. This shift represents a significant change in financial communication and might initially create uncertainty among investors who have historically relied on billings as a key performance metric.

The transition to RPO guidance underscores a fundamental shift in how PANW communicates its financial health. While this may challenge investors accustomed to traditional metrics, it aligns with the company’s broader strategy of focusing on long-term recurring revenues. Although this change might lead to some initial investor concern, it reflects a mature approach to financial reporting that emphasizes the growing importance of predictable, ongoing revenue streams over one-time sales or short-term metrics.

Understanding this shift requires investors to recalibrate how they assess PANW’s financial outlook. This transition to RPO signifies the company’s long-term vision and enhances the predictability of revenue performance. While billings have traditionally provided a snapshot of immediate financial health, RPO offers insight into the company’s sustained financial engagements. This strategy aligns seamlessly with Palo Alto Networks’ ongoing focus on subscription-based models and recurring revenue.

Competitive Market Challenges

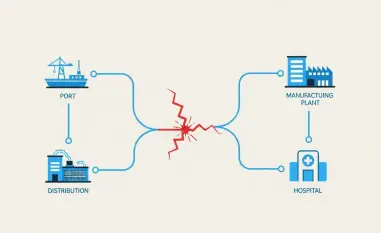

Navigating the competitive landscape of cybersecurity continues to be a critical challenge for Palo Alto Networks. The market is crowded with established players and new entrants vying for a share, making differentiation and innovation essential for continued success. This competition imposes price pressure, which could potentially compress margins and impact revenue growth.

Technological advancements are another persistent challenge. In a field where the nature of threats evolves rapidly, maintaining a cutting-edge product portfolio demands significant investment in research and development. This need for continuous innovation can strain resources but is essential to stay ahead of both cyber threats and competitors.

Moreover, as PANW’s customer base grows, the company faces the challenge of sustaining high growth rates, particularly in mature market segments. Market saturation could become a concern, requiring the company to explore new markets and customer segments actively.

Acquiring and retaining top talent is another hurdle. The cybersecurity industry is notorious for its skills shortage, and the ability to attract and keep skilled professionals is critical for maintaining high service levels and driving innovation. The talent crunch could impact the company’s operational effectiveness and growth potential.

Lastly, global economic headwinds pose a threat. Economic slowdowns can lead to reduced IT spending, which could impact PANW’s growth prospects. Enterprises might delay or reduce their cybersecurity investments during economic downturns, affecting the company’s revenue.

Opportunities and Strategic Growth Areas

While the competitive landscape presents challenges, it also opens several growth avenues for Palo Alto Networks. The rising demand for cloud security solutions stands out as a significant opportunity. With businesses increasingly migrating to cloud operations, the addressable market for cloud security is expanding rapidly. PANW’s strong presence in the cloud security domain positions it to capitalize on this trend effectively.

The company’s focus on integrated solutions also aligns well with market needs. Enterprises are increasingly looking for comprehensive security platforms that simplify management and enhance overall security posture. PANW’s platformization strategy, which integrates various security solutions into a single, cohesive offering, meets this demand and opens cross-selling opportunities.

Strategic acquisitions present another growth avenue. Targeted acquisitions can enhance PANW’s product offerings, expand its market reach, and accelerate innovation. This approach enables the company to stay ahead of technological advancements and broaden its capabilities, adding value to its existing portfolio.

The increasing cybersecurity spending due to evolving cyber threats offers a favorable market condition. Governments and enterprises alike are ramping up their cybersecurity investments, providing a growing market for PANW’s solutions. Additionally, geographic expansion into new markets and industry verticals can drive growth, offering untapped revenue streams.

Lastly, the emphasis on emerging technologies like AI and machine learning provides a competitive edge. AI-driven solutions can enhance the sophistication and adaptability of security measures, offering more effective protection against advanced cyber threats. This focus on innovation helps PANW maintain its leadership position and meet the evolving needs of its customers.

Analyst Targets

Analysts have generally maintained a positive outlook on Palo Alto Networks, reflected in their price targets, which range from $330 to $410. Major financial institutions and analysts have shown confidence in PANW’s growth trajectory based on its robust financial performance and strategic initiatives.

For instance, Barclays has set a target of $410, indicating strong confidence in the company’s future prospects. Similarly, RBC Capital Markets and Cantor Fitzgerald have both placed their targets at $410, aligning with Barclays’ optimistic view. BTIG and Deutsche Bank also show a positive outlook with targets at $395.

Jefferies and Evercore ISI both see the potential for PANW stock to reach $400, further underscoring the favorable sentiment among analysts. Wolfe Research sets a target at $385, while Mizuho and BMO Capital Markets are slightly more conservative, with targets at $380 and $390, respectively. BofA Securities places its target at $370, and Piper Sandler offers a somewhat cautious target of $330.

These price targets, while varied, collectively highlight a consensus among analysts about PANW’s strong market position and future growth potential. They reflect confidence in the company’s strategic direction, financial health, and ability to navigate the competitive cybersecurity landscape.

Conclusion

Palo Alto Networks (PANW) has established a significant position in the constantly changing world of cybersecurity. The company’s strong financial performance, strategic undertakings, and relentless drive for innovation have laid a firm groundwork for sustained growth. This article explores the numerous elements that not only make Palo Alto Networks a current industry leader but also a company primed for future success.

The firm’s innovations have consistently pushed the boundaries of cybersecurity, helping organizations protect their digital assets in an increasingly vulnerable online landscape. Among the highlights are their next-generation firewall solutions, advanced endpoint protection, and cloud security. These offerings have solidified PANW’s reputation for delivering reliable, cutting-edge security solutions.

Moreover, Palo Alto Networks has made several strategic acquisitions, broadening its range of services and integrating more comprehensive solutions for its clients. These calculated moves have enabled the company to adapt quickly to market needs and technological advancements.

Financially, PANW has shown robust growth, with consistent revenue increases and a strong balance sheet. Their commitment to research and development further underscores their ambition to stay ahead in a competitive market. The company’s dedication to innovation and strategic expansion positions it well for continued success in the evolving cybersecurity landscape.