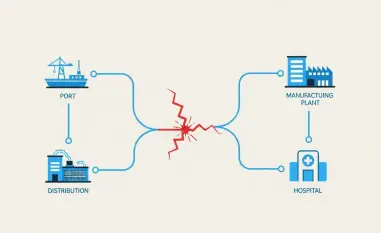

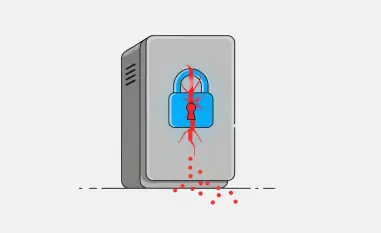

In an alarming event, cybercriminals managed to divert over 540 million Brazilian reais (approximately $100 million) using PIX, the robust instant payment system deeply entrenched in Brazil’s financial architecture. This breach, executed with precision, revealed vulnerabilities within the system, chiefly through targeting C&M, a pivotal software entity in PIX operations. Arrests have been made, including a former employee through whom the hackers accessed critical credentials. This breach underscored potential cybersecurity gaps, fueled by sophisticated social engineering tactics rather than inherent system flaws, prompting a reconsideration of PIX’s security frameworks.

Overview of Brazil’s Financial Payment System

Brazil’s PIX system represents a revolution in domestic payment mechanisms, characterized by its instant payment capability, which allows users to transfer funds 24/7, virtually eliminating the lag of conventional banking procedures. PIX’s inception has facilitated a financial inclusion wave, blending rapid transaction speeds with ease of access across different socio-economic strata. Managed by the Central Bank of Brazil, PIX’s infrastructure demands continuous technological enhancement, regulated by stringent guidelines aimed at safeguarding users, making its robustness an economic linchpin.

Key technological integrations within PIX hinge on interoperability with diverse financial entities, creating a dynamically interconnected finance landscape. Major players include leading banks and fintech firms that collaborate under the regulatory oversight of the Central Bank, ensuring compliance with comprehensive security protocols. Despite its robust architecture, PIX remains susceptible to evolving cyber threats, prompting the need for an expansive security posture.

Current Trends in Instant Payment Systems

Key Trends Influencing PIX and Similar Systems

Emerging in a constantly evolving digital landscape, instant payment systems like PIX are shaped by innovative technologies and market catalysts. Digitalization and enhanced mobile banking are central drivers, empowering consumers with unprecedented transactional power. Shifting consumer behaviors highlight an increased preference for seamless, secure transactions, signaling a significant opportunity for further financial technology innovations. The advent of real-time payment technologies positions systems like PIX at the forefront of digital economy transformations.

Market Performance and Growth Projections

Instant payment systems show strong market performance, characterized by rising user adoption and transaction volumes. Projections indicate this trend will persist with the continuous integration of digital payment solutions into daily financial transactions. This trajectory suggests a favorable environment for fintech companies investing in technological advancements tailored to meet evolving consumer expectations.

Challenges Facing PIX

Despite its success, PIX encounters several challenges, including technological hurdles like cybersecurity threats, regulatory compliance pressures, and operational complexities. The recent attack on its system highlighted vulnerabilities tied to human factors, such as social engineering, requiring increased investment in robust security measures and continuous monitoring. Implementing cutting-edge cybersecurity technologies constitutes a potential strategy to mitigate such risks, thereby fortifying system integrity against future attempts.

Additionally, the regulatory landscape poses challenges as compliance demands evolve. Adapting to these changes requires financial institutions to regularly update their operational practices, fostering a dynamic balance between regulatory adherence and operational efficiency.

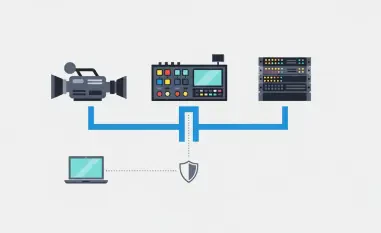

Regulatory Environment and Security Measures

Security measures and regulatory frameworks significantly influence the operations of PIX, ensuring that system integrity and user data are safeguarded. Brazilian financial regulations underscore strict compliance mandates, emphasizing protective measures against potential breaches. These regulatory acts play a critical role in fostering trust and ensuring PIX and analogous platforms adhere to the highest security standards.

Moreover, the continuous evolution of regulations reflects the necessity of robust compliance strategies that adapt to technological advancements. Strengthened security frameworks, alongside proactive regulatory measures, are crucial for maintaining the trustworthiness and reliability of payment systems.

Future Directions for PIX and Payment Systems

The trajectory of PIX lies in its ability to innovate in response to market changes and consumer demands. As financial technologies advance, PIX’s expansion and enhancement will rely on integrating emerging technologies, such as artificial intelligence and machine learning, to preempt cyber threats effectively. Identifying and adapting to potential disruptors will be paramount in shaping the future of digital payments, ensuring sustained growth and consumer confidence.

Potential disruptors might include new entrants in the financial landscape, such as blockchain-based solutions that could impact current payment ecosystems. Therefore, a proactive stance towards innovation and regulatory adaptation will be vital as payment systems evolve.

Conclusion and Recommendations

Reflecting on recent events, it is evident that while PIX transformed Brazil’s financial system with unparalleled speed and efficiency, it faces critical security challenges. The cyberattack highlighted vulnerabilities in human-centric elements rather than systemic flaws, underscoring the necessity for enhanced vigilance and adaptive security strategies. Future recommendations include bolstering cybersecurity measures, investing in advanced technological innovations, and maintaining strict regulatory compliance to preemptively address evolving threats. These actions will be essential in preserving the reliability of Brazil’s financial landscape, presenting growth opportunities for stakeholders within the digital payments sector.