Setting the Stage for Cybersecurity Evolution

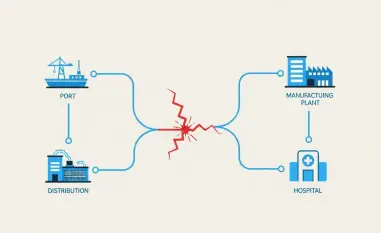

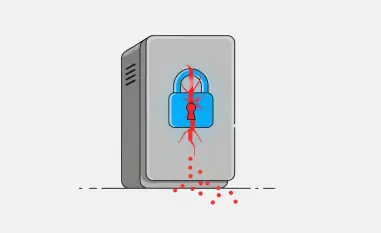

In an era where cyber threats loom larger than ever, with phishing attacks costing an average of $14,500 per incident and denial-of-service attacks hitting $18,750 per occurrence, the urgency to safeguard digital assets has never been more critical. As businesses navigate distributed workforces and sprawling multi-cloud environments, traditional security models crumble under the weight of modern challenges. This market analysis delves into the meteoric rise of Security Service Edge (SSE), a cloud-native approach redefining cybersecurity. With the global SSE market valued at $2.9 billion in 2024 and projected to reach $24.6 billion by 2033 at a compound annual growth rate (CAGR) of 26.8%, the stakes—and opportunities—are immense. This examination unpacks current trends, key drivers, and future projections, offering a comprehensive look at how SSE is shaping the cybersecurity landscape.

Deep Dive into Market Trends and Projections

Unpacking SSE’s Rapid Market Expansion

The SSE market is experiencing unprecedented growth, driven by escalating cyber risks and the shift toward cloud-based security solutions. Starting from a robust base in recent years, projections indicate the market will expand from its current valuation to $24.6 billion by 2033, reflecting a CAGR of 26.8%. This surge is fueled by the urgent need for flexible architectures that protect remote employees and multi-cloud setups, areas where legacy perimeter defenses fall short. North America leads with a commanding 39.22% market share as of last year, underpinned by advanced cloud infrastructure and stringent regulatory frameworks. Large enterprises, holding a 68% adoption rate, dominate implementation, leveraging their resources to integrate SSE platforms effectively.

Beyond raw numbers, the momentum is evident in organizational intent. A recent survey of IT and cybersecurity leaders shows that 79% of organizations plan to deploy an SSE platform within the next 24 months, a significant jump from prior figures. This rapid uptake underscores a broader recognition of SSE as a linchpin for securing digital operations. However, challenges such as latency in traffic routing and integration complexities with existing systems persist, particularly for smaller firms with limited budgets. Despite these hurdles, the market’s trajectory points to SSE becoming a cornerstone of cybersecurity strategies across industries.

Zero Trust and Cloud-Native Solutions as Growth Catalysts

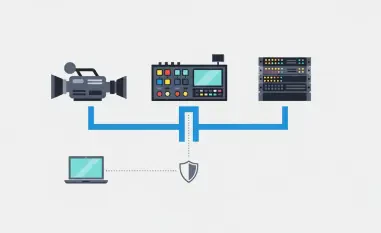

A pivotal driver of SSE adoption is the alignment with Zero Trust security principles, which advocate a “never trust, always verify” approach. This framework resonates deeply in a distributed world, where securing access regardless of location is paramount. The Banking, Financial Services, and Insurance (BFSI) sector, accounting for 32% of the SSE market, exemplifies this trend, using SSE to enforce granular access controls and mitigate data breach risks. Cloud-native architectures further amplify growth, with 70% of organizations currently opting for public cloud-based SSE solutions due to their scalability and adaptability.

This shift away from on-premises hardware toward cloud-delivered security is reshaping investment priorities. Organizations are increasingly valuing platforms that offer real-time threat protection and seamless integration with existing tools. Yet, the transition is not without friction—skill shortages in managing advanced systems and potential performance bottlenecks remain notable barriers. Still, the market’s focus on Zero Trust and cloud-native models signals a maturing landscape, where flexibility and proactive defense are non-negotiable for staying ahead of sophisticated threats.

SSE as a Stepping Stone to SASE Integration

Another defining trend is SSE’s role as a foundational element of broader Secure Access Service Edge (SASE) strategies. Currently, 62% of organizations view SASE as a core corporate priority, with 59% starting their SASE journey through SSE implementation. This phased approach allows businesses to build scalable security frameworks before tackling full networking and security convergence. Market data suggests that companies prioritizing SSE-first strategies achieve faster SASE deployment compared to those attempting simultaneous integration of multiple components.

The preference for unified solutions is also notable, with 61% of organizations favoring single-vendor SASE platforms that combine SSE with Software-Defined Wide Area Network (SD-WAN) capabilities. While this streamlines deployment, it introduces risks like vendor lock-in, potentially limiting flexibility in adapting to future threats. Balancing the efficiency of unified architectures with the agility to pivot as needed is a critical consideration for market players. As SSE continues to pave the way for SASE, its influence on holistic security planning is undeniable, shaping investment and innovation in the cybersecurity space.

Regional and Sectoral Dynamics in Adoption Patterns

Market dynamics reveal stark variations in SSE adoption across regions and industries, adding layers of complexity to global trends. North America’s dominance, driven by robust technological ecosystems and compliance demands, contrasts with slower uptake in regions with constrained resources or less mature cloud infrastructures. Sectorally, BFSI leads due to high-stakes data protection needs, while other industries, such as retail or manufacturing, lag behind, often due to budget limitations or a lack of specialized expertise.

These disparities highlight a key insight: SSE is not a universal fix but requires tailored deployment to address specific regulatory and operational contexts. For instance, large enterprises can absorb integration costs more readily than smaller counterparts, which struggle with both financial and technical barriers. Market analysis suggests that bridging these gaps—through accessible training programs or cost-effective solutions—will be essential for broader adoption. Understanding these nuances is vital for stakeholders aiming to capitalize on SSE’s growth while navigating its diverse challenges.

Emerging Innovations and Future Market Shifts

Looking ahead, the SSE market is poised for transformation through technological advancements and evolving priorities. The integration of artificial intelligence and machine learning for proactive threat detection is gaining traction, promising smarter, more responsive security systems. Convergence with SD-WAN continues to redefine network security, enabling seamless performance and protection in distributed environments. Economic pressures, such as the rising cost of cyber incidents, alongside stricter data protection regulations, are expected to accelerate adoption over the coming years.

Projections indicate that by 2030, SSE could become a standard component of cybersecurity frameworks, with innovations like AI-driven analytics playing a central role in anticipating threats. The market’s shift toward simplicity and efficiency—evident in the growing preference for unified, cloud-native platforms—suggests a future where scalability is paramount. As these trends unfold, SSE is set to redefine how organizations approach digital defense, positioning itself as an indispensable tool in an increasingly complex threat landscape.

Reflecting on Insights and Strategic Pathways Forward

This analysis reveals that the Security Service Edge market has embarked on a remarkable growth path, with projections estimating a climb to $24.6 billion by 2033. The alignment with Zero Trust principles, the pivot to cloud-native architectures, and the strategic role as a gateway to SASE underscore SSE’s transformative impact on cybersecurity. Regional and sectoral disparities, alongside emerging innovations like AI integration, paint a nuanced picture of a market both thriving and challenged by integration complexities and skill gaps.

Moving forward, organizations are advised to assess their security gaps meticulously, prioritizing SSE platforms that align with existing infrastructure for smoother transitions. Partnering with trusted providers emerges as a critical step, given the high financial toll of cyber incidents. Investment in training to bridge skill shortages and a phased approach to SASE adoption offer practical avenues to maximize SSE’s benefits while mitigating risks like vendor lock-in. Tailoring strategies to meet specific regulatory and industry demands further ensures that defenses remain robust and relevant in a dynamic digital era.