In an era where cyber threats loom larger than ever, with data breaches and ransomware attacks costing businesses billions annually, the search for reliable cybersecurity investments feels like striking gold in a volatile market. Fortinet Inc. (ticker: FTNT) emerges as a shining contender, blending impressive growth with a valuation that doesn’t break the bank. Despite a recent stock price stumble following cautious guidance in early August, the company’s fundamentals remain unshakable, positioning it as a prime “Growth At a Reasonable Price” (GARP) opportunity. This narrative explores how Fortinet stands out in the crowded cybersecurity space, weaving together its market dominance, financial prowess, and strategic foresight to argue why savvy investors should take notice. Far from a fleeting trend, Fortinet’s story is one of resilience and untapped potential in a sector that’s only growing more critical by the day.

Why Fortinet Stands Out in Cybersecurity

Market Leadership and Innovation

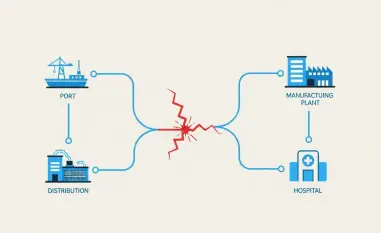

Fortinet’s grip on the cybersecurity landscape is nothing short of commanding, particularly in the firewall market where it holds over 50% of the global share of deployed network firewalls. This isn’t just a number—it’s a testament to the trust placed in Fortinet’s solutions as the first line of defense between trusted internal networks and the wild, untrusted expanse of the internet. Firewalls remain the backbone of its revenue stream, but what’s equally compelling is how the company isn’t resting on its laurels. By pushing boundaries into emerging fields like Secure Access Service Edge (SASE) for cloud environments, Fortinet shows it’s in tune with the shift toward remote and hybrid work models. This pivot addresses modern security needs where traditional perimeters no longer suffice, signaling a forward-thinking approach that could cement its relevance for years to come.

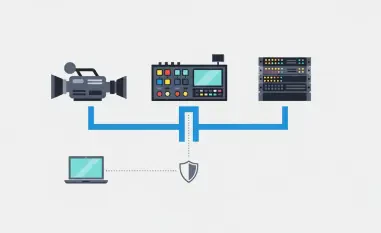

Moreover, innovation is baked into Fortinet’s DNA, as evidenced by its arsenal of over 1,400 patents, with more than 500 tied to artificial intelligence. This isn’t just about bragging rights; it’s about staying ahead in a game where cyber threats evolve daily. The integration of AI into products like Software-Defined Wide Area Networking (SD-WAN) optimizes network traffic with a precision that manual systems can’t match. Such advancements position Fortinet to tackle the complexities of digital transformation, where businesses demand not just security but efficiency. While competitors scramble to catch up, Fortinet’s proactive expansion into high-growth areas suggests a vision that balances current market needs with future challenges, making it a standout for investors seeking sustainable growth.

Industry Trends and Growth Potential

The broader trend of digitalization acts as a powerful tailwind for Fortinet, with businesses and individuals increasingly reliant on interconnected systems that demand robust protection. As cloud adoption soars and remote work becomes the norm, the need for comprehensive security solutions has never been more urgent. Fortinet’s diverse portfolio, spanning traditional firewalls to cutting-edge SASE offerings, ensures it can meet these evolving demands head-on. This isn’t a niche play; it’s a strategic alignment with a structural shift in how the world operates, where cybersecurity isn’t optional but foundational. Fortinet’s ability to capitalize on this wave speaks to its long-term growth potential in a sector that shows no signs of slowing down.

However, it’s worth noting that Fortinet operates in a landscape shaped by more than just opportunity—competition is fierce, and staying ahead requires relentless innovation. What sets the company apart is its proven track record of adapting to change, whether through AI-driven solutions or expanding into untapped markets. Unlike some peers who focus narrowly on specific niches, Fortinet’s broad approach offers a buffer against market shifts, ensuring it isn’t overly reliant on a single product line. This adaptability, paired with a deep well of technological expertise, paints a picture of a company not just surviving but thriving amid industry currents. For investors, this translates to a bet on a player that’s as much about stability as it is about upside.

Financial Strength and Strategic Moves

Solid Metrics and Valuation Advantage

Turning to the numbers, Fortinet’s financial performance reads like a masterclass in balancing growth with profitability, a rare feat in the often-speculative cybersecurity space. In Q2, the company posted a 14% year-over-year revenue jump to $1.63 billion, underpinned by stable gross profit margins of 81.3% and a net income margin of 30.6%. Earnings per share soared by 54%, fueled by rising earnings and a reduced share count from repurchases. Since its 2009 IPO, Fortinet has consistently generated positive free cash flow, boasting a 32% margin, while its balance sheet gleams with $4.56 billion in cash against just $1 billion in debt. These figures aren’t just stats—they’re a signal of a business built for endurance, capable of weathering storms that might topple less disciplined competitors.

What’s even more striking is Fortinet’s valuation, which screams opportunity when stacked against industry peers. At a price-to-earnings (P/E) ratio of 32x and a price-to-earnings-to-growth (PEG) ratio of 0.67x, it looks like a bargain compared to names like Zscaler, with a price-to-sales (P/S) ratio of 16.5x, or Cloudflare at a staggering 41.4x, neither of which turn a profit. Even against profitable giants like Palo Alto Networks (P/S of 14.4x) and Crowdstrike (25.4x), Fortinet’s 9.8x P/S ratio suggests room to run. This isn’t about chasing hype; it’s about recognizing a company whose price doesn’t yet reflect its growth trajectory. For those hunting value in a high-growth sector, Fortinet offers a compelling case that’s hard to ignore, blending fiscal strength with a discount rarely seen in this space.

Share Repurchase as a Catalyst

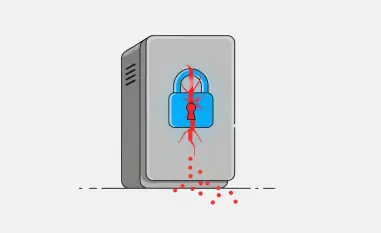

Beyond raw numbers, Fortinet’s management is playing a smart game with capital allocation, most notably through an aggressive share repurchase program. Recently, the company pumped an additional $1 billion into its buyback initiative, extending it through February 2027. This isn’t a hollow gesture—it’s a clear vote of confidence from leadership in the company’s future, signaling that they believe the stock is undervalued. Historically, Fortinet has timed these repurchases well, snapping up shares during downturns like the 2022-2023 bear market and easing off during bullish runs. Following the recent price dip in August, this strategy could accelerate, providing a floor for the stock price while enhancing shareholder value in tangible ways.

Additionally, this move serves as a stabilizing force in turbulent times, offering a buffer against the kind of volatility that spooked investors after the early August guidance. Share repurchases reduce the number of outstanding shares, potentially boosting earnings per share over time and rewarding long-term holders. It’s a reminder that Fortinet isn’t just reacting to market whims but actively shaping its financial destiny. For investors wary of downside risks in an uncertain economy, this strategy adds a layer of reassurance, underscoring management’s commitment to not just growth but also protecting capital. In a sector where trust is paramount, such actions speak louder than promises, positioning Fortinet as a thoughtful steward of investor interests.

Navigating Challenges and Future Outlook

Digital Growth and Macro Risks

On a macro level, Fortinet is riding a wave of digital transformation that shows no sign of cresting, with cybersecurity demand surging as businesses migrate to cloud-based systems and grapple with escalating threats. This isn’t a fleeting fad; it’s a fundamental shift in global infrastructure where security solutions like Fortinet’s firewalls and SASE offerings are mission-critical. The company’s broad product range and technological edge—bolstered by AI innovations—ensure it’s not just keeping pace but setting the standard. As digitalization deepens across industries, from healthcare to finance, Fortinet’s role as a guardian of data and networks positions it for sustained relevance, offering investors exposure to a trend with structural staying power.

Yet, the road isn’t without bumps, as macroeconomic headwinds cast a shadow over near-term prospects. Uncertainty around tariffs and a slowing U.S. economy has led to cautious guidance from Fortinet’s management, hinting at potential delays in customer capital spending. Analyst downgrades following the August report have added pressure, reflecting market jitters about short-term performance. However, these challenges appear overstated when weighed against the company’s raised full-year billings guidance, which suggests underlying confidence in demand. For investors, this tension between temporary hurdles and enduring tailwinds frames Fortinet as a calculated risk—one where patience could yield outsized rewards as broader economic clouds eventually lift.

Seizing the Moment for Long-Term Gains

Looking back, Fortinet navigated a market overreaction in August with the kind of grit that defined its rise, maintaining robust fundamentals despite a stock price drop that seemed disconnected from reality. Historical growth—over 250% in five years and 800% in ten—underscored a trajectory that temporary setbacks couldn’t derail. That period of volatility ultimately revealed a rare chance to invest in a cybersecurity leader at a discount, blending proven performance with a forward-looking vision. The company’s response, from financial discipline to strategic buybacks, painted a picture of resilience worth banking on.

Moving forward, the path for investors seems clear: consider Fortinet as a cornerstone in a portfolio aimed at capitalizing on the digital age’s security imperatives. With cyber threats only set to multiply, aligning with a market leader that offers growth at a reasonable price could be a defining move. Keep an eye on how management navigates macro challenges while pushing innovation—those dynamics will shape the next chapter. For now, the opportunity to invest in a company so deeply embedded in the future of technology beckons as a strategic step toward long-term value creation.