The allure of quick fortunes in the cryptocurrency market has unfortunately created a fertile hunting ground for sophisticated criminals who prey on the trust and ambition of everyday investors. The U.S. Securities and Exchange Commission (SEC) has recently cast a harsh spotlight on this dark side of digital finance, filing federal charges against a network of crypto platforms and investment clubs accused of orchestrating a meticulous $14 million confidence scam. This enforcement action is more than just a single case; it serves as a critical examination of modern financial fraud. By deconstructing the scam, understanding the SEC’s legal rationale, and highlighting the broader consequences, investors can gain invaluable insights into protecting their assets in an increasingly complex digital landscape.

Unpacking the SEC’s Crackdown on a Sophisticated Crypto Fraud

The SEC’s recent charges detail a wide-ranging scheme that allegedly defrauded American retail investors from January 2024 through January 2025. This was not a simple hack but a calculated operation involving multiple fraudulent entities and a patient, psychological approach to deception. The sheer scale of the fraud, totaling over $14 million, prompted a decisive federal response aimed at halting the operation and holding its architects accountable.

This case provides a powerful illustration of the regulatory challenges and enforcement priorities in the digital asset space. It highlights the methods fraudsters use to exploit social media and the promise of new technology to build unwarranted trust. Examining the anatomy of this fraud, from initial contact to the final theft, reveals the critical role regulatory bodies like the SEC play in policing these emerging markets and protecting the public from predatory schemes that threaten to undermine the integrity of the financial system.

The SEC’s Mandate: Protecting Retail Investors from Digital Threats

At its core, the SEC’s intervention in cases like this stems from its foundational mission: to protect investors, maintain fair and orderly markets, and facilitate capital formation. The agency acts as a crucial line of defense for the public, particularly for retail investors who may lack the resources to vet complex investment opportunities on their own. When fraudulent actors create fictitious platforms and offer non-existent securities, they directly violate the principles of market fairness and transparency that the SEC is sworn to uphold.

Consequently, the enforcement action carries benefits that extend far beyond recovering the stolen $14 million. By publicly charging the alleged perpetrators, the SEC sends a powerful deterrent message to other would-be scammers, signaling that the digital frontier is not a lawless space. Moreover, such actions reinforce market integrity, helping to build public confidence that regulatory bodies are actively monitoring and combating threats. Safeguarding investors from these “all-too-common” scams is essential for the healthy, long-term development of the digital asset industry.

Anatomy of the Confidence Scam: How Investors Were Deceived

This particular fraud was not a single event but a carefully orchestrated, multi-stage confidence scam designed to disarm and deceive investors over time. The perpetrators understood that trust is the most valuable currency in any financial relationship and dedicated their initial efforts to manufacturing it. They built a system that slowly drew victims in, normalized the investment process, and made the final transfer of funds feel like a logical and safe next step.

The entire scheme can be broken down into a clear, repeatable process that is a hallmark of modern investment fraud. It began with a sophisticated recruitment effort that leveraged social media to create a false sense of community and expertise. Once investors were inside this controlled environment, they were systematically guided toward fraudulent trading platforms where their funds could be siphoned away without a trace. The SEC’s complaint meticulously documents this journey, offering a playbook on how such deception is achieved.

Stage One: Luring Victims Through Social Media and Investment Clubs

The initial phase of the scam was centered on recruitment through social media promotions and private messaging applications like WhatsApp. Fraudsters created online investment clubs that appeared exclusive and professional, inviting potential victims into what seemed like a privileged circle of savvy investors. This approach capitalized on the fear of missing out and the desire to be part of an in-the-know community.

Inside these closed groups, a sense of camaraderie and trust was carefully cultivated. The scammers, posing as seasoned financial advisors, would engage with members, answer questions, and build personal rapport. By creating an echo chamber where all information was controlled by them, they could effectively shape the perceptions of their victims, making them more receptive to the investment “opportunities” that would soon be presented.

Case Study: AI Wealth Inc. and the Promise of AI-Powered Tips

Entities like AI Wealth Inc. and Lane Wealth Inc. served as the public faces of this recruitment effort. They cleverly used the allure of artificial intelligence—a powerful and often misunderstood technology—to lend an air of legitimacy and sophistication to their operation. The promise of “AI-powered” trading tips suggested a system that was smarter, faster, and more reliable than human intuition, making it an incredibly compelling hook for investors.

Within the private WhatsApp groups, these clubs would share fake trading advice and manufactured success stories, seemingly validating their AI-driven strategy. This provided social proof that the system worked, building investors’ confidence to the point where they were eager to participate. It was a classic confidence trick updated for the digital age, using technological buzzwords to mask a fundamentally simple fraudulent scheme.

Stage Two: Funneling Funds to Fraudulent Trading Platforms

With trust firmly established, the fraudsters initiated the second and most critical stage of the scam: moving investors’ money into their control. Members of the investment clubs were instructed to open and fund accounts on specific crypto trading platforms. This transition was presented as the natural next step toward realizing the profits promised by the AI-powered tips they had been receiving.

This handoff was seamless because the victims believed they were moving their funds to a secure, third-party platform for legitimate trading. In reality, these platforms were nothing more than elaborate digital storefronts created and controlled entirely by the scammers. Every dollar deposited was immediately diverted, with no actual trading ever taking place.

The Fake Exchanges: Morocoin, Berge Blockchain, and Cirkor Inc

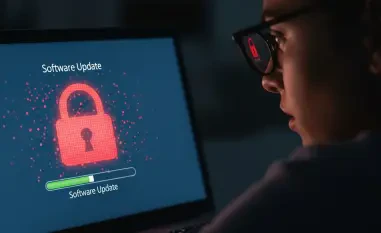

The fraudulent platforms—including Morocoin Tech Corp., Berge Blockchain Technology Co. Ltd., and Cirkor Inc.—were designed to mimic the appearance and functionality of legitimate cryptocurrency exchanges. They featured professional-looking websites, user dashboards showing fake account balances, and what appeared to be real-time market data, all contributing to a powerful illusion of authenticity.

To further bolster their credibility, these fake exchanges falsely claimed to be licensed by government authorities and even offered sophisticated products like non-existent “Security Token Offerings” (STOs) supposedly tied to real companies. This created multiple layers of deceit that were difficult for an average investor to penetrate. The final, cruel twist came when investors tried to withdraw their “profits” and were told they had to pay substantial advance fees and taxes, compounding their losses in a last-ditch effort to extract more money.

The Aftermath: Legal Action and a Warning for the Crypto Community

In response to this elaborate scheme, the SEC has taken decisive legal action in federal court, citing clear violations of the anti-fraud provisions of U.S. securities laws. The agency is seeking permanent injunctions to halt the operation, the return of all ill-gotten gains with interest, and significant civil penalties against the platforms and individuals involved. This legal response underscores that while the technology may be new, the fundamental principles of securities law still apply with full force.

This case serves as a stark and timely warning for the entire crypto community. The tactics employed here—luring investors through social media, building false trust in private groups, and funneling funds to imitation platforms—are disturbingly common. For investors, the key takeaway is the importance of extreme diligence. It is crucial to be skeptical of unsolicited investment offers, independently verify the registration and licensing of any trading platform, and recognize that guarantees of high returns powered by secretive technologies are almost always a red flag for fraud. Regulatory oversight is a vital safeguard, but the first line of defense remains an informed and cautious investor.