Small businesses with lean teams and tight margins have increasingly found that a single cyber incident can knock out core systems, disrupt sales, and trigger a costly scramble to recover, even when the breach started with nothing more than a phish or a misconfigured account exposed to the internet. What looked like a remote hazard has become a day‑to‑day operating risk, and the question is no longer whether attackers care about smaller targets, but whether those targets can absorb the hit without lasting damage. This has sharpened attention on cyber insurance, which now blends financial protection with hands‑on support and underwriting‑driven improvement. The key decision hinges on economics: compare premium and deductible against plausible incident frequency and the long tail of impact, including productivity loss, revenue at risk, and erosion of trust that lingers long after systems come back online.

Why Small Businesses Face Outsized Cyber Risk

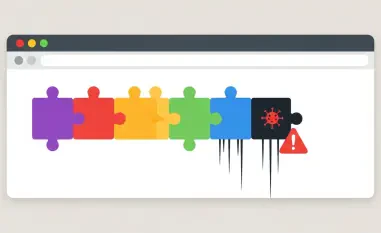

Attackers tilt toward smaller firms because lean defenses produce quicker wins and fewer roadblocks, and because human error is so often the entry point that brute‑force sophistication is unnecessary. Most incidents still start with a user slip, a reused password, or a missed patch, and the consequences compound faster when teams are stretched thin. Ransomware has shown a particular bias toward companies under 1,000 employees, where even one day of downtime can break service‑level promises, clog order pipelines, and push customers to competitors. Moreover, smaller organizations tend to rely on a handful of revenue‑critical systems, making any outage a single point of failure. The result is not an exotic threat profile but an operational reality that rewards attackers’ persistence.

Incident Frequency and Business Disruption

Breaches, ransomware, and availability incidents recur often enough to be treated as high‑probability events rather than black swans, and that frequency changes how risk should be priced in planning. Many small firms report disruptions lasting 8 to 24 hours per incident, which is more than enough to miss fulfillment windows, stall support queues, and trigger refunds or service credits. Even short outages ripple across payroll, scheduling, customer care, and sales pipelines, increasing the likelihood that near‑term losses spill into future quarters through attrition and reduced referrals. Because many incidents involve overlapping issues—compromised credentials, lateral movement, and cloud misconfigurations—the response rarely ends with a quick reboot. Instead, teams face a coordinated recovery effort while juggling legal questions and customer expectations.

Premiums, Deductibles, and Pricing Drivers

Entry‑level policies around million in limits often sit in the lower‑ to mid‑four‑figure premium range with four‑figure deductibles, creating a predictable annual cost compared with the uncertain severity of an attack. As limits rise to million or million, premiums and retentions scale accordingly, especially for higher‑risk verticals such as healthcare or firms that handle sensitive personal data. Underwriters heavily weight revenue, industry exposure, and demonstrated security maturity, and firms that can validate controls like MFA, tested backups, EDR, patch cadence, employee training, and encryption tend to secure better terms. That dynamic shifts the conversation from “insurance as a sunk cost” to “insurance as a price signal” that rewards proactive defense with measurable savings and reliable access to specialized response resources when trouble hits.

Where the Real Costs Live

The visible bill for forensics and restoration represents only one slice of a breach, and focusing on headline figures often understates the real business hit. Recovery work can stretch from tens of thousands to several hundred thousand dollars as teams rebuild systems, validate data integrity, and harden access. Meanwhile, lost productivity mounts as staff pause routine work to assist investigations, and revenue shortfalls emerge when transactions stall or services go dark. The longer arc can be worse: damaged trust depresses renewals, increases churn, and forces higher acquisition spends to backfill lost accounts. Any legal or regulatory response adds attorney fees, potential fines, and notification and monitoring costs. When these components are modeled together, the expected annualized exposure can easily surpass a modest premium and deductible.

How Insurance Helps Before an Incident

Modern cyber policies now function as a catalyst for improvement before anything goes wrong, using underwriting as a structured assessment that surfaces gaps in controls and processes. Insurers commonly request evidence of MFA across accounts, tested backups with documented recovery objectives, EDR deployment, timely patching, ongoing user training, and encryption for devices and sensitive data. That scrutiny behaves like a free audit: it flags weak access paths, stale software, or untested disaster recovery plans, and it offers actionable guidance to remediate issues that would otherwise linger. Improving these controls not only qualifies a business for coverage and better pricing but also reduces the probability and blast radius of an incident. The net effect is a lower‑risk baseline and a stronger negotiating position with carriers.

How Insurance Helps During and After an Incident

When an incident begins, speed and coordination matter more than anything, and policies increasingly bundle 24/7 hotlines, incident response teams, digital forensics, legal counsel, and crisis communications to compress that timeline. Experienced responders bring playbooks for ransomware containment, data recovery, and stakeholder updates, reducing mistakes that prolong downtime or inflate scope. In parallel, coverage helps absorb covered expenses beyond the deductible, including specialized forensics, restoration, notification, and credit monitoring. Legal guidance structures regulatory reporting and privilege, while PR support preserves customer confidence with clear, timely messaging. This integrated response shortens dwell time and curbs secondary damage, turning a chaotic scramble into a managed event with defined roles, escalations, and decision gates that align technical, legal, and reputational priorities.

Baseline Controls and Rising Requirements

Insurers have steadily raised the floor on eligibility, and those requirements align with practices that materially reduce risk in small‑business environments. Multi‑factor authentication for privileged and remote access, immutable backups with regular restore testing, EDR with containment features, documented patch cycles, user awareness programs with phishing simulations, and encryption at rest and in transit are now widely expected. Proof is often gathered through detailed questionnaires, control attestations, and, in some cases, independent audits. Adoption trends point upward as firms standardize on these controls to maintain coverage and negotiate better terms. The broader effect is market‑level uplift: when minimum standards rise, common attack paths shrink, and resilience becomes less dependent on individual heroics and more a function of well‑run processes and tooling that insurers help validate.

Policy Mechanics: Limits, Exclusions, and Services

Cyber coverage remains contractual, not unlimited, and understanding the mechanics prevents surprises when the clock is ticking. Exclusions can apply to intentional insider acts, certain nation‑state scenarios, vendor failures beyond a policy’s scope, or losses tied to noncompliance with stated safeguards. Conditions may include prompt reporting, carrier‑approved vendors, and caps or stipulations on ransom payments. Balanced against these boundaries is a suite of value‑added services that spans digital forensics and incident response, legal and regulatory guidance, notification logistics, credit monitoring, public relations, and ransomware negotiation expertise. These services address the whole incident lifecycle—from containment to communication—and often deliver more practical value than a simple reimbursement check, especially for teams that lack in‑house security, legal, or crisis communications capabilities at scale.

The Investment Case: A Risk‑Based Model

A sound decision relies on modeling expected exposure rather than chasing average breach numbers that mask huge variance. Start by estimating downtime cost per hour for the most critical processes, identify revenue at risk when sales or service systems go offline, and consider long‑term attrition from trust damage that pushes renewals down and CAC up. Map that impact against plausible incident frequency for the business profile, and the math often shows that premium plus deductible is outweighed by expected losses, especially once long‑tail outcomes are included. Importantly, policies also buy speed: access to response experts shortens recovery, which directly lowers exposure. With underwriting pushing better controls, insured firms tend to prevent more incidents and mitigate those that do occur, further tilting the calculus in favor of coverage as a hedge.

Buyer’s Playbook for Right‑Sizing Coverage

The most effective purchases began with quantifying downtime and revenue at risk, then translating those figures into limits and deductibles that matched operational realities and cash tolerance. Teams validated that MFA, backups, EDR, patching, training, and encryption met carrier standards, compared terms such as panel vendors, waiting periods, and ransomware sublimits, and clarified reporting timelines and breach‑coach access. Scenarios were mapped for likely outages, including who called the hotline, which systems were isolated first, and how customers were notified. A broker aligned markets to the firm’s profile and negotiated improvements where controls supported them. By the time signatures were on the policy, leadership had already rehearsed the first 24 hours, understood exclusions and caps, and locked in the partners who would shorten recovery and stabilize the business.