We’re thrilled to sit down with Malik Haidar, a seasoned cybersecurity expert with years of experience protecting multinational corporations from digital threats and hackers. With a deep background in analytics, intelligence, and security, Malik has a unique perspective on blending business strategies with robust cybersecurity measures. Today, we’re diving into the alarming rise of caller ID spoofing—a growing menace highlighted by Europol—exploring how criminals exploit this tactic, the challenges in combating it, and what can be done to protect individuals and organizations from these deceptive attacks.

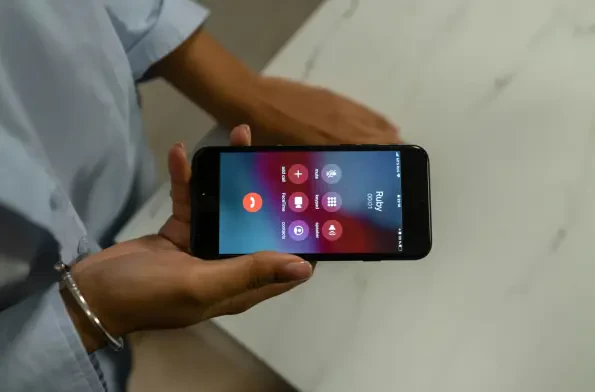

Can you break down what caller ID spoofing is and how criminals use it to deceive people?

Absolutely. Caller ID spoofing is a technique where criminals manipulate the phone number that appears on your caller ID to make it look like the call is coming from a trusted source, like your bank, a government agency, or even a family member. They use specialized software or services to disguise their real number, tricking victims into thinking the call is legitimate. This lowers your guard, making you more likely to share sensitive information or follow their instructions, like transferring money. It’s a classic social engineering tactic—playing on trust and urgency to exploit human behavior.

What’s behind the recent surge in caller ID spoofing attacks across Europe and beyond?

Several factors are driving this uptick. First, the technology to spoof numbers has become incredibly accessible and cheap, even for low-level criminals. You don’t need to be a tech genius to pull it off anymore. Second, the global nature of communication means attackers can operate from anywhere, often in jurisdictions with lax enforcement, making it hard to catch them. Europol’s data showing spoofing in 64% of phone fraud cases reflects how effective it is—people still trust their caller ID, and criminals know that. Plus, the rise of remote work and digital transactions has given fraudsters more opportunities to impersonate institutions we rely on.

How are organized crime groups leveraging caller ID spoofing for their operations?

Organized crime has turned spoofing into a sophisticated business. They use it for a range of scams—impersonating banks to steal account details, posing as government officials to demand payments, or even pretending to be a relative in distress to extort money. What’s particularly concerning is the emergence of “spoofing-as-a-service,” where tech-savvy criminals sell spoofing tools or services to others for a fee. It’s like a criminal marketplace, lowering the barrier for entry and allowing less skilled fraudsters to launch attacks, which amplifies the scale and impact of these schemes.

What are some of the most severe consequences of these spoofing attacks for individuals and society?

The fallout can be devastating. On a personal level, victims lose money, sensitive data, and sometimes their sense of security. But it gets darker with tactics like swatting, where criminals use spoofed numbers to make fake emergency calls, prompting police or SWAT teams to respond to a nonexistent crisis at someone’s home. This endangers lives and wastes critical resources. For law enforcement and emergency services, these incidents create chaos, diverting attention from real emergencies and straining budgets. It’s a ripple effect that harms entire communities, not just the targeted individual.

What makes it so difficult for investigators to track down and stop criminals behind caller ID spoofing?

The challenges are immense. Many of these criminals operate across borders, hiding in countries where law enforcement cooperation is limited or nonexistent. Spoofed numbers are often routed through multiple systems, making traceback a technical nightmare. On top of that, there’s a lack of standardized tools and protocols among nations to share information quickly. Europol has pointed out issues like unclear police roles and poor coordination with telecom providers, which means even when a crime is reported, investigators often hit dead ends due to bureaucratic or technical barriers.

What strategies is Europol advocating to combat this growing threat, and how could they help?

Europol has laid out three key priorities that I think are spot-on. First, they’re pushing for harmonized technical standards—essentially, uniform ways to authenticate caller IDs and trace fraudulent calls. This would make spoofing harder to pull off undetected. Second, they want stronger cross-border collaboration, bringing law enforcement, regulators, and industry players together to share intel and act swiftly. Third, they’re calling for regulatory convergence to streamline rules around caller ID usage and make legal traceback requests more efficient. Together, these steps could close gaps that criminals exploit and make investigations faster and more effective.

Are there any examples of countries successfully fighting back against caller ID spoofing that we can learn from?

Yes, Finland’s 2021 initiative stands out as a great case study. They implemented a system to block unverified international calls that used Finnish numbers, working closely with telecom providers and other stakeholders. This multi-pronged approach drastically reduced spoofing incidents originating from abroad by stopping those calls before they even reached potential victims. Other countries can take a page from this book—focus on prevention through partnerships and leverage technology to filter out bad actors at the source. It’s not a silver bullet, but it’s a strong start.

How do you think criminals will adapt as new defenses against spoofing are rolled out?

Criminals are incredibly adaptable, and as defenses improve, they’ll pivot to other methods. Europol has warned about emerging threats like SIM-based scams, where fraudsters trick people into swapping or handing over SIM cards, or smishing, which is phishing via text messages. They might also lean on anonymous prepaid services to mask their identities further. The cat-and-mouse game never stops in cybersecurity—when one door closes, they’ll look for another. That’s why staying ahead requires constant vigilance, updating protections, and educating the public on evolving risks.

What advice do you have for our readers to protect themselves from falling victim to caller ID spoofing?

My biggest piece of advice is to never fully trust your caller ID. If a call seems urgent or suspicious—even if it looks like it’s from a trusted source—take a moment to verify. Hang up and call the official number of the organization or person directly. Never share personal information like passwords or bank details over the phone unless you’re 100% sure of who you’re talking to. Also, consider using call-blocking apps or services that flag potential spam. And finally, stay informed—scammers evolve, so knowing the latest tricks can be your best defense. If something feels off, trust your gut and double-check.