The landscape of cybersecurity is undergoing a profound transformation with the integration of artificial intelligence (AI), particularly in the critical area of fraud prevention. As industries such as financial services and healthcare face increasingly sophisticated cyber threats, AI stands at the forefront, offering innovative tools to detect and mitigate fraudulent activities while also presenting new vulnerabilities exploited by malicious actors. Recent discussions among industry leaders at prominent cybersecurity summits have shed light on this complex dynamic, revealing both the promise and peril of AI in safeguarding digital ecosystems. This technology’s ability to analyze vast datasets in real time and identify subtle anomalies is revolutionizing how organizations protect themselves, yet it also equips fraudsters with advanced tactics like deepfakes and automated attacks. This article delves into the multifaceted role of AI in fraud prevention, exploring its potential to enhance security measures while addressing the challenges it introduces in an ever-evolving threat landscape.

AI’s Dual Role in Cybersecurity

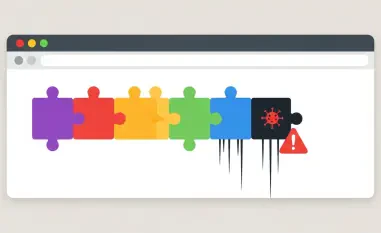

The dual nature of artificial intelligence in cybersecurity presents a compelling paradox for fraud prevention strategies. AI has become an invaluable asset, empowering organizations to detect and respond to fraudulent behavior with unprecedented speed and accuracy. By leveraging machine learning algorithms, security systems can sift through enormous volumes of data to pinpoint irregularities that might indicate fraud, such as unusual transaction patterns or login anomalies. This capability allows for proactive measures, often stopping threats before they cause significant harm. Beyond detection, AI automates routine tasks within security operations centers, freeing up human analysts to focus on complex issues. Such efficiency is crucial in an era where cyber threats are not only frequent but also increasingly intricate, requiring rapid response mechanisms to maintain trust and operational integrity across digital platforms.

However, the same technology that fortifies defenses also arms cybercriminals with sophisticated tools to perpetrate fraud on a massive scale. Fraudsters are exploiting AI to craft highly convincing scams, including deepfake videos that mimic trusted individuals and automated spear-phishing campaigns tailored to specific targets. These tactics often bypass traditional security protocols, as they exploit human psychology rather than technical vulnerabilities. The rise of such AI-driven attacks underscores the urgent need for organizations to adapt by enhancing their own AI capabilities while establishing strict governance frameworks. Without proper oversight, the risk of misuse grows, potentially undermining the very systems designed to protect. Balancing the innovative potential of AI with the threats it amplifies remains a pivotal challenge, necessitating a strategic approach to implementation that prioritizes ethical considerations and robust data security to stay ahead of evolving dangers.

Fraud’s Evolution into a Business Priority

Fraud has transcended its traditional classification as a mere technical glitch to emerge as a pressing strategic concern for businesses across sectors. This shift reflects a broader understanding that fraudulent activities impact far more than just IT infrastructure; they threaten reputation, erode customer confidence, and expose organizations to significant regulatory penalties. Industry leaders now recognize the importance of integrating fraud prevention into enterprise risk management frameworks, ensuring alignment with overarching business objectives. This holistic perspective elevates the issue to the boardroom, where executives are increasingly held accountable for safeguarding not only financial assets but also the trust and goodwill of stakeholders. As a result, investments in advanced technologies like AI are being prioritized to address these multifaceted risks with comprehensive, forward-thinking strategies.

Moreover, treating fraud as a core business risk demands a cultural shift within organizations, fostering collaboration across departments that were once siloed. Legal, operational, and compliance teams now work alongside cybersecurity experts to build resilient systems that can withstand both internal and external threats. This cross-functional approach is vital in an environment where the consequences of fraud extend beyond immediate financial loss to long-term reputational damage. By embedding fraud prevention into strategic planning, companies can better anticipate potential vulnerabilities and deploy AI-driven solutions to mitigate them effectively. Such integration also ensures that resources are allocated not just reactively but with an eye toward future-proofing operations against emerging threats, acknowledging that fraud’s impact resonates at every level of an organization and requires a unified, proactive stance to manage effectively.

Challenges in Identity Security

In the AI-driven cybersecurity landscape, identity security has become a critical battleground as traditional verification methods struggle to keep pace with evolving threats. The proliferation of synthetic identities, created using AI to mimic legitimate user profiles, poses a significant challenge to conventional systems reliant on static credentials. Additionally, credential-based attacks, often fueled by massive data leaks, have eroded trust in password-centric models, leaving organizations vulnerable to unauthorized access. To counter these risks, AI offers innovative solutions such as adaptive authentication, which adjusts security protocols based on real-time risk assessments, ensuring that access is granted only under verified conditions. This dynamic approach marks a departure from outdated methods, focusing on continuous validation to protect sensitive environments.

Insider threats further complicate the identity security puzzle, as malicious or negligent actions from within an organization can bypass external defenses. AI-driven monitoring tools play a pivotal role here, analyzing behavioral patterns to detect anomalies that might indicate misuse of credentials or unauthorized activities. Complementing this, zero trust architectures are gaining traction as a fundamental strategy, operating on the principle of never assuming trust, even for internal users. By requiring ongoing verification and limiting access to only what is necessary, zero trust minimizes the potential for lateral movement by attackers. As threats grow more sophisticated, blending AI with zero trust principles offers a robust framework to safeguard identities, ensuring that organizations can maintain integrity across expanding digital footprints while addressing the nuanced risks posed by both external fraudsters and internal vulnerabilities.

Regulatory Drivers for AI Adoption

Regulatory frameworks are increasingly shaping the adoption of AI in fraud prevention, pushing organizations to align their cybersecurity practices with stringent legal mandates. In regions like New York, cybersecurity regulations impose tight deadlines and hefty penalties for non-compliance, compelling businesses to integrate AI tools that enhance risk management and reporting capabilities. These mandates are not mere formalities but catalysts for building mature security postures that can withstand scrutiny from both regulators and insurers. Demonstrating compliance often requires leveraging AI to automate documentation, monitor third-party risks, and ensure supply chain visibility, areas that are under growing focus as attack surfaces expand. Such requirements highlight the intersection of technology and governance, where AI serves as a bridge to meet evolving standards.

Beyond immediate compliance, regulatory pressures are driving a deeper transformation in how organizations approach fraud prevention. The need to quantify cyber risks and present measurable outcomes to stakeholders has led to increased investment in AI systems that provide actionable insights and predictive analytics. This shift is particularly evident in industries like financial services, where the stakes of regulatory lapses are exceptionally high, affecting not just operations but also market confidence. Insurers, too, are raising the bar, demanding evidence of robust cybersecurity practices before underwriting policies, further incentivizing the use of AI for real-time threat assessment. As these external forces converge, the role of AI becomes not just tactical but strategic, enabling companies to navigate a complex web of obligations while fortifying their defenses against fraud in a highly regulated digital environment.

Building Resilience with Zero Trust

The consensus around zero trust as a foundational model for fraud prevention underscores its importance in an AI-driven cybersecurity era. Unlike traditional perimeter-based defenses, which are increasingly obsolete in hybrid and cloud-centric environments, zero trust operates on the premise of continuous verification, ensuring that no user or device is inherently trusted, regardless of location. When paired with AI-driven monitoring, this approach enables organizations to detect and respond to threats in real time, preventing lateral movement by attackers who gain initial access. Such a strategy is particularly effective against sophisticated fraud schemes that exploit insider credentials or mimic legitimate behavior, offering a layered defense that adapts to the dynamic nature of modern cyber risks across expanding digital landscapes.

A data-first mindset complements zero trust, emphasizing the protection of information at every stage of its lifecycle, from development to deployment. AI tools enhance this by providing granular visibility into endpoints, networks, and applications, identifying vulnerabilities that might otherwise go unnoticed in overlooked environments like testing systems. Transitioning to passwordless authentication, supported by AI analytics, further strengthens security by eliminating a common attack vector. This combination of zero trust and data-centric strategies builds resilience, ensuring that organizations are not just reacting to fraud but proactively mitigating risks before they materialize. As threats grow more pervasive, embedding these principles into operational frameworks becomes essential, creating a robust shield against the evolving tactics of cybercriminals leveraging AI for malicious purposes.

Future Pathways for Secure Innovation

Reflecting on the insights shared by industry experts at recent cybersecurity summits, it becomes evident that the journey of integrating AI into fraud prevention has reached a critical juncture. The discussions illuminated how AI has reshaped defensive capabilities, enabling real-time threat detection and automation that outpaces manual efforts. Yet, the simultaneous empowerment of fraudsters through AI-driven tactics like deepfakes underscores the necessity for stringent governance and ethical guidelines. Looking ahead, organizations must prioritize the development of adaptive frameworks that balance innovation with accountability, ensuring that AI tools are deployed with clear oversight to prevent misuse. Investing in cross-industry collaboration and intelligence sharing will be vital to stay ahead of emerging threats, while continuous training for staff on AI’s evolving role can bridge knowledge gaps. As the cybersecurity landscape progresses, exploring upcoming virtual summits focused on AI implications offers a promising avenue to refine strategies, fostering a collective effort toward a more secure digital future.