The unassuming cash machine on the corner has become the latest battleground in the fight against international terrorism, as a sophisticated scheme transforms ATMs into unwilling financiers for a designated foreign terrorist organization. The U.S. Department of Justice has unsealed indictments against 54 individuals connected to the Venezuelan gang Tren de Aragua (TdA) for their roles in a sprawling, multi-million-dollar ATM “jackpotting” conspiracy that has siphoned over $40 million from financial institutions across the United States. This massive law enforcement action shines a harsh spotlight on the dangerous intersection of organized crime, advanced cyber warfare, and the funding of global terrorism. The operation, which involved a complex blend of physical intrusion and malicious software, served as a direct revenue stream for the TdA’s broader criminal empire, which includes drug trafficking, human smuggling, and extortion, demonstrating how digital vulnerabilities can be exploited to fuel real-world violence and instability.

The Anatomy of a High-Tech Heist

Blending Cyber Warfare with Physical Intrusion

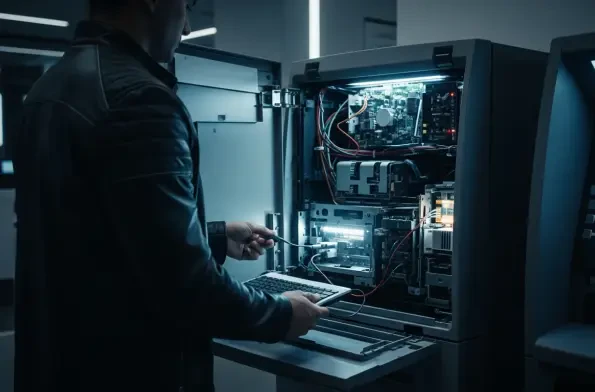

The success of this extensive criminal operation hinged on a meticulously planned fusion of digital hacking and traditional, hands-on criminal techniques. The Tren de Aragua network began by recruiting a network of individuals, often referred to as “money mules,” to perform the crucial on-the-ground tasks. Their initial responsibility was reconnaissance, identifying and scoping out vulnerable ATM models in various locations. This was followed by a critical test phase where a mule would physically open the machine’s hood, a compartment housing its internal components, to check for the presence of silent security alarms. This low-tech approach was essential to ensure that the subsequent, more invasive steps would not immediately trigger a law enforcement response. This hybrid model represents a significant evolution in financial crime, moving beyond purely remote hacking to a cyber-physical threat that requires a coordinated presence at the target location, making it both more complex to execute and more difficult for authorities to trace back to its digital origins without apprehending the physical operatives.

Once a target ATM was deemed safe for attack, the operation transitioned from physical probing to digital subterfuge. The operatives on the ground gained access to the machine’s internal computer system using one of two methods. The first involved completely replacing the ATM’s existing hard drive with one that had been pre-loaded with a specialized malware known as Ploutus. The second, more common method, involved using a removable USB drive to introduce the malware onto the machine’s system. After the Ploutus malware was installed, it effectively gave the criminals complete control over the ATM’s cash dispenser. The money mule, equipped with a physical keyboard plugged into the machine and a unique activation code, could then issue unauthorized commands, forcing the ATM to dispense large sums of cash in a process aptly named “jackpotting.” To cover their tracks, the malware was engineered with a self-erasing feature, designed to scrub evidence of its presence from the system’s logs after the heist was complete, complicating forensic investigations and allowing the gang to reuse their methods.

The Enduring Threat of Ploutus Malware

While the scale of the TdA operation is alarming, the primary tool used in the heists, the Ploutus malware, is far from new. It first surfaced in Mexico back in 2013, marking one of the earliest known instances of malware specifically designed for ATM jackpotting. Over the years, its code has been analyzed and documented by prominent cybersecurity firms, including Symantec and FireEye, which have detailed its various versions and attack vectors. The malware’s longevity and continued effectiveness are a testament to its sophisticated design, which exploits fundamental vulnerabilities in the architecture of many ATM systems. Its operation has always required the critical human element of a money mule on-site, who needs a master key to open the machine’s physical casing, a keyboard to interact with the illicit software interface, and a time-sensitive activation code to trigger the final cash-out command. The TdA’s ability to operationalize this decade-old malware on such a massive scale demonstrates how criminal organizations can adopt, refine, and deploy existing cyber weapons to devastating effect.

The technical prowess of the Ploutus malware lies in its ability to directly interface with the ATM’s core hardware components, bypassing the standard software and security layers that govern legitimate transactions. Once installed, it intercepts communications between the ATM’s central processing unit and its cash dispenser module. This allows the attacker to issue direct commands to the dispenser, effectively telling it to eject all available bills from its cassettes without needing a debit card, a PIN, or any form of bank authorization. The activation code system adds a layer of control for the masterminds of the operation, ensuring that the on-site mules cannot initiate a cash-out without explicit, real-time permission from the syndicate’s leadership. This centralized command-and-control structure transforms the ATM from a secure banking terminal into a remote-controlled cash faucet, which the TdA network systematically turned on in over 1,500 documented incidents to drain millions of dollars from the U.S. financial system.

A Criminal Enterprise with Global Reach

The Shadowy Network of Tren de Aragua

The organization at the heart of this cybercrime conspiracy, Tren de Aragua, is a powerful and notoriously violent transnational criminal gang originating from Venezuela. Its dangerous influence has led the U.S. State Department to officially designate it as a Foreign Terrorist Organization (FTO), placing it in the same category as other groups that pose a significant threat to national security. The TdA is helmed by its leader, Hector Guerrero Flores, who was the target of sanctions announced in July 2025 for his role in orchestrating the gang’s vast illicit activities. These criminal enterprises are far-reaching and diverse, including international drug trafficking operations, extensive human smuggling rings that prey on vulnerable populations, brutal extortion rackets targeting businesses and individuals, and sophisticated money laundering networks designed to legitimize their ill-gotten gains. The ATM jackpotting scheme was not an isolated act of theft but an integral component of this broader criminal portfolio, providing a crucial and direct source of untraceable cash to fuel the organization’s violent expansion and terrorist activities.

The financial impact of this long-running scheme is staggering, with U.S. officials confirming that the TdA network is responsible for financial losses totaling approximately $40.73 million as of August 2025. This figure, compiled from 1,529 documented jackpotting incidents since 2021, underscores the systematic and industrial scale of the operation. Law enforcement authorities have emphasized that these tens of millions of dollars were not simply pocketed by low-level criminals but were methodically funneled up the chain of command directly to the senior leadership of Tren de Aragua. These funds were then allegedly used to finance the group’s core terrorist activities, purchase weapons, bribe officials, and expand its operational footprint across the Americas. This direct line from a compromised ATM in a U.S. city to the coffers of a designated FTO highlights a critical modern security challenge where cybercrime and terrorism financing have become inextricably linked, forcing a reevaluation of how financial infrastructure must be protected.

The Legal Hammer Falls

In a decisive response to this widespread threat, the Department of Justice has brought the full weight of the U.S. legal system against the perpetrators. The 54 indicted defendants are implicated in two separate indictments, which were issued in October and December 2025 following a multi-agency investigation. The charges leveled against them are severe and reflect the multifaceted nature of their criminal conspiracy. They include conspiracy to commit bank fraud, which targets the overarching plot to defraud financial institutions; bank burglary, for the physical act of breaking into the ATM machines to install the malware; computer fraud, for the unauthorized access and manipulation of the ATM’s internal systems; and money laundering, for the subsequent efforts to conceal the illicit origins of the stolen cash. This comprehensive legal strategy aims not only to punish the individual foot soldiers but to dismantle the entire operational hierarchy of the TdA network within the United States, from the on-site mules to the regional coordinators and money movers.

The gravity of the charges is matched by the severity of the potential penalties the accused now face. If convicted, the defendants are subject to substantial mandatory minimum sentences and could face maximum prison terms ranging from 20 to an astounding 335 years. These stringent potential sentences are intended to send a clear message to transnational criminal organizations that leveraging technology to attack the U.S. financial system will be met with a formidable and uncompromising judicial response. The indictments represent the culmination of a years-long effort to combat a persistent and evolving threat. The sheer volume of incidents—1,529 documented attacks since 2021—paints a picture of a relentless campaign against the nation’s financial infrastructure. This sweeping law enforcement action marks a significant victory in disrupting a critical funding pipeline for a dangerous terrorist organization and serves as a stark warning to other syndicates engaged in similar cyber-physical criminal activities.

Fortifying the Financial Frontier

This landmark case ultimately demonstrated the critical vulnerabilities that persist at the intersection of physical and digital security. The successful dismantling of this $40 million scheme underscored the urgent need for financial institutions to accelerate the modernization of their ATM fleets, integrating more robust physical safeguards with next-generation cybersecurity protocols capable of detecting and thwarting sophisticated malware like Ploutus. The coordinated law enforcement action that led to the 54 indictments also highlighted the indispensable role of international cooperation in confronting transnational criminal syndicates like Tren de Aragua. The investigation served as a powerful reminder that the digital ether knows no borders, and tracking illicit funds from a compromised machine in the U.S. to the leadership of a terrorist organization abroad required a seamless partnership between domestic and global agencies. It was a clear illustration that the threats of tomorrow will demand an even more integrated and technologically adept response to protect both financial and national security interests.