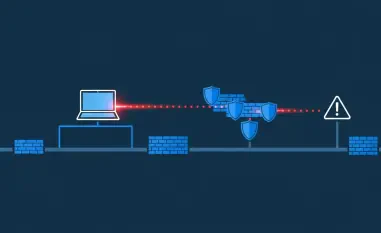

The sudden and complete disappearance of funds from a digital wallet represents one of the most significant fears for participants in the burgeoning world of decentralized finance and prediction markets, a fear that recently became a stark reality for customers of Polymarket. The platform has confirmed a significant security incident that allowed attackers to breach several user accounts and systematically drain their balances. At the heart of this breach was a critical vulnerability not within Polymarket’s own code, but stemming from a third-party authentication provider integrated into its login system. This event serves as a potent reminder of the complex and often hidden risks associated with interconnected digital ecosystems, where the security of one platform is intrinsically linked to the integrity of its partners. In response, Polymarket has moved to reassure its community, but the incident has already sparked intense discussion about platform liability and the inherent dangers of relying on external services for core functionalities like user authentication and asset management.

The Anatomy of the Attack

The breach first surfaced not through an official announcement, but from a series of alarming user testimonials that painted a clear picture of a coordinated attack. One user on Reddit chronicled a distressing experience, noting three suspicious login attempts on their account in quick succession, immediately followed by the discovery that their entire wallet balance had been wiped out. Critically, this individual asserted that their personal security was not at fault; their devices remained secure, pointing to a vulnerability exploited at the platform level. This account was quickly reinforced by another user on the X platform, who reported a similar draining of their Polymarket wallet despite not having clicked on any phishing links or fallen for other common social engineering scams. These firsthand reports were crucial in demonstrating that the attack vector was an internal system failure rather than a widespread lapse in individual user security, shifting the focus and responsibility squarely onto the platform’s infrastructure and its integrated services.

In the wake of these user reports, Polymarket issued a public statement via its Discord channel, acknowledging the security flaw and detailing its immediate response. The company confirmed it had successfully identified the vulnerability, which originated from an external authentication tool, and had deployed a fix to remediate the issue completely. According to the platform, the threat has been neutralized, and there is no longer an ongoing risk to user accounts or their funds. While Polymarket has maintained that only a “small number” of users were directly impacted by this sophisticated breach, it has made a commitment to contact each affected individual to address the financial losses and manage the fallout. Community investigation and speculation have since pointed toward Magic Labs, a third-party wallet provider, as the potential source of the vulnerability, given that the compromised accounts were reportedly created using its service. Polymarket, however, has not officially named the specific third-party provider responsible for the security gap.

A Pattern of Vulnerability and Future Implications

This security event is not an unprecedented challenge for the prediction market platform, but rather the latest in a series of incidents that highlight a recurring vulnerability. A similar situation unfolded in late 2024 when users who relied on Google accounts for their platform login reported that their funds had been inexplicably drained in a comparable fashion. This prior breach established a troubling pattern, suggesting a systemic weakness in how the platform integrates and manages third-party authentication services. The repetition of such incidents underscores a significant and overarching trend within the broader digital asset space: the inherent security risks associated with outsourcing critical functions. Whether for user login or wallet management, relying on external integrations introduces potential points of failure that can be exploited by malicious actors. The consensus emerging from these repeated events is the paramount importance of not only rigorously vetting third-party providers initially but also implementing continuous monitoring and security audits to safeguard user assets against an evolving threat landscape.

The resolution of the immediate threat marked the beginning of a broader reckoning for platforms that leverage third-party integrations for core functionalities. This breach served as a critical case study, illustrating how vulnerabilities in an external partner’s system could cascade and directly impact a platform’s user base, leading to significant financial loss and erosion of trust. It highlighted the non-negotiable necessity for any organization in the digital asset industry to conduct exhaustive due diligence on its technology partners and to establish robust contingency plans for such security failures. The incident ultimately reinforced the principle that while third-party tools can offer convenience and streamlined development, the ultimate responsibility for user security remained with the primary platform. This event prompted a wider industry conversation about establishing stricter standards for third-party integrations and fostering greater transparency regarding the security dependencies that underpin many popular applications.