As the financial services industry grapples with an evolving landscape of cyber threats, the importance of resilience has never been clearer. Today, we’re joined by Malik Haidar, a seasoned cybersecurity expert with a wealth of experience in safeguarding multinational corporations from digital threats. With a deep background in analytics, intelligence, and security, Malik brings a unique perspective on integrating business needs with robust cybersecurity strategies. In this conversation, we’ll explore the transformation of cyber resilience into a regulatory imperative, the impact of global frameworks, the necessity of collaboration across teams, and the innovative tools shaping the future of crisis preparedness in financial services.

Can you walk us through what cyber resilience means for financial institutions today and how its role has evolved in recent years?

Cyber resilience in financial services today goes beyond just preventing attacks—it’s about ensuring an organization can withstand, adapt, and recover from cyber incidents with minimal disruption. A few years ago, it was seen as a competitive edge or a best practice, something forward-thinking firms adopted to stay ahead. But with the rise in sophisticated threats and high-profile breaches, it’s become a core operational necessity. The stakes are higher now; a single incident can erode customer trust, trigger massive financial losses, and invite regulatory penalties. This shift is driven by the recognition that cyberattacks are inevitable, so the focus has moved to preparedness and recovery, not just defense.

What has driven cyber resilience to become a regulatory requirement rather than just a recommended practice?

The push toward regulation comes from the systemic risks that cyber incidents pose to the financial sector. Governments and regulatory bodies worldwide realized that individual firm failures can cascade through the economy, so they’ve stepped in with mandates. Frameworks like DORA in the EU, CPS230 and CORIE in Australia, and others in regions like the UK and US, set clear expectations for resilience. These regulations often require firms to demonstrate their ability to handle crises through exercises and simulations, ensuring they’re not just checking boxes but actually building robust systems. It’s a response to the growing complexity of threats and the interconnected nature of financial systems.

How do global regulations like DORA in the EU impact financial institutions in terms of operational changes?

DORA, or the Digital Operational Resilience Act, is a game-changer for EU financial entities. It mandates a comprehensive approach to managing ICT risks, pushing firms to identify critical functions, map dependencies, and test their resilience regularly. This means organizations must integrate risk management into their core operations, not treat it as an afterthought. They’re required to report incidents promptly and conduct regular testing through scenarios like tabletop exercises. It’s a shift toward accountability, forcing firms to prove they can bounce back from disruptions, which often requires significant investment in technology, training, and cross-departmental coordination.

What challenges do financial institutions face when navigating multiple regulatory frameworks across different regions?

The biggest challenge is the lack of uniformity. While regulations like DORA and CPS230 share common goals, their specific requirements, timelines, and reporting standards can differ. A multinational firm might need to comply with EU rules for one branch and Australian or US guidelines for another, creating a patchwork of obligations. This can strain resources, as teams must tailor their processes and documentation to each jurisdiction. There’s also the risk of conflicting priorities—focusing on one region’s mandate might divert attention from another. Harmonizing these requirements into a cohesive strategy without duplicating effort is a constant balancing act.

Why is collaboration between technical and non-technical teams so essential for meeting these cyber resilience mandates?

Cyber resilience isn’t just a tech problem; it’s a business problem. Technical teams like IT and security handle the nuts and bolts—detecting threats, patching systems—but non-technical teams like legal, compliance, and executive leadership manage the broader impact, from regulatory reporting to customer communication. Regulations often require a holistic response, so these groups must work in sync. Without collaboration, you risk misaligned priorities or delayed decisions during a crisis. For instance, a technical fix might be ready, but if leadership isn’t looped in on communication strategies, the public fallout could still be disastrous.

How can tabletop exercises and simulations help bridge the gap between these diverse teams?

Tabletop exercises and simulations are invaluable because they create a safe space to practice crisis response together. They bring technical folks and business leaders to the same table—literally—to walk through scenarios like a ransomware attack or data breach. Technical teams can explain the mechanics of an incident, while non-technical staff can focus on stakeholder management or legal implications. This builds mutual understanding and trust. Plus, simulations like red team exercises add a layer of realism, testing actual systems and responses, which helps everyone see the stakes and refine their roles before a real crisis hits.

The shift away from basic tools like Excel for managing these exercises is notable. What limitations do you see in using such tools for today’s complex needs?

Excel is great for simple tasks, but it’s woefully inadequate for the scale and intricacy of modern cyber resilience exercises. It can’t handle the dynamic nature of scenarios that involve multiple variables—think detailed threat actor profiles, timelines, technical injects, and response tracking. There’s no way to automate or integrate real-time data, and it’s prone to human error when managing large teams or datasets. Plus, it lacks the ability to simulate realistic communication flows or technical alerts, which are critical for authenticity. As regulations demand more frequent and sophisticated testing, relying on static spreadsheets just slows everything down.

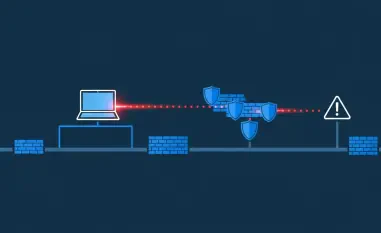

How do advanced platforms enhance the way these exercises are planned and executed?

Advanced platforms bring automation, integration, and realism to the table. They can pull in threat intelligence, generate technical attack scenarios, and simulate human interactions like emails or alerts—all in one environment. This cuts down on prep time and ensures consistency across exercises. They also sync with enterprise systems to keep participant data current, which is a logistical nightmare in manual tools. Most importantly, they provide analytics and reporting capabilities, so firms can measure performance, identify gaps, and demonstrate compliance to regulators. It’s about turning a cumbersome process into something streamlined and actionable.

What are the benefits of blending tabletop exercises with technical simulations like red teaming in a single platform?

Blending these approaches creates a more holistic test of an organization’s readiness. Tabletop exercises focus on decision-making and communication, while red team simulations test technical defenses and detection capabilities. Combining them means you’re not just theorizing about a crisis—you’re seeing how technical failures impact human responses in real time. For example, a simulated ransomware alert can trigger a chain of emails and decisions, mirroring an actual incident. This dual approach helps teams understand cause and effect across the organization, making training more impactful and revealing weaknesses that might be missed in isolated exercises.

Looking ahead, what is your forecast for the future of cyber resilience in financial services?

I see cyber resilience becoming even more embedded in the DNA of financial institutions. As threats grow more sophisticated—think AI-driven attacks or deepfake scams—regulations will tighten further, demanding continuous testing and adaptation. We’ll likely see greater standardization across global frameworks to ease compliance burdens, but also more emphasis on real-time resilience metrics, not just periodic exercises. Technology will play a bigger role, with platforms evolving to integrate AI for predictive threat modeling and automated response drills. Ultimately, the goal is to move from reacting to crises to anticipating them, building a culture where resilience is second nature, not just a mandate.